Crunchy CSRD data, Switch repairability, GHG protocol updates, & zombie fires emerging in Canada… It’s GTG Links 62

Greetings! We’re back for another look at the key sustainability developments from the games industry and the wider world. But first…

The Sustainable Games Alliance invites you to join Ubisoft’s Andrea Carrara, Ad Net Zero’s Anthony Falco, and me for a meetup discussing the role of emissions from digital advertising in the games industry.

Digital advertising is an essential part of the games industry, as a major channel for connecting with and acquiring new players, to a significant revenue stream for F2P games. To date, the primary method of measuring the GHG impact of these activities has been spend-based, relying on estimates derived from dollars, and providing precious little control over emissions and certainly no transparency over the underlying activity.

In the session, Andrea will discuss the scale of the challenge of digital advertising for Ubisoft, being a major component of their Scope 3 emissions, and share some of the approaches the Ubisoft team have tried to utilise to measure and reduce them.

Then, Anthony will share how sustainability experts in the advertising industry are enabling more accurate measurement of digital channel advertising emissions by clarifying the activities and process stages involved in getting digital ads in front of gamers’ eyeballs. Attendees will get an introduction to the Global Media Sustainability Framework (GMSF) published by Ad Net Zero, and be invited to participate in a discussion about how best to make use of the methodological guidance it provides, and what the games industry can do collectively to reduce the footprint of this essential channel for reaching gamers.

It’s going to be well worth attending if you can make it, as there’s a lot for us to learn from each other. I hope to see you there on the 26th!

More ESG Reports! From MTG & Embracer

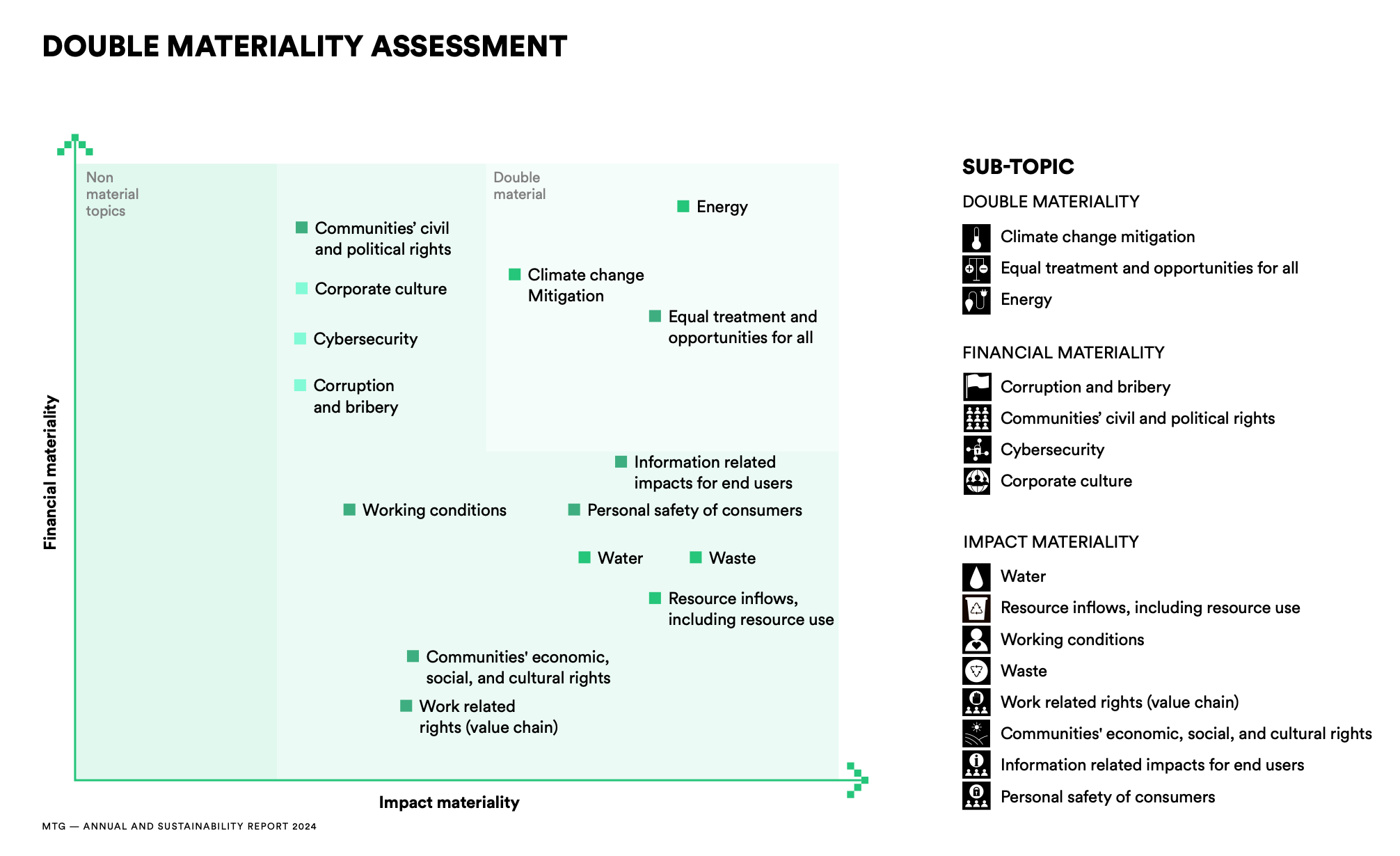

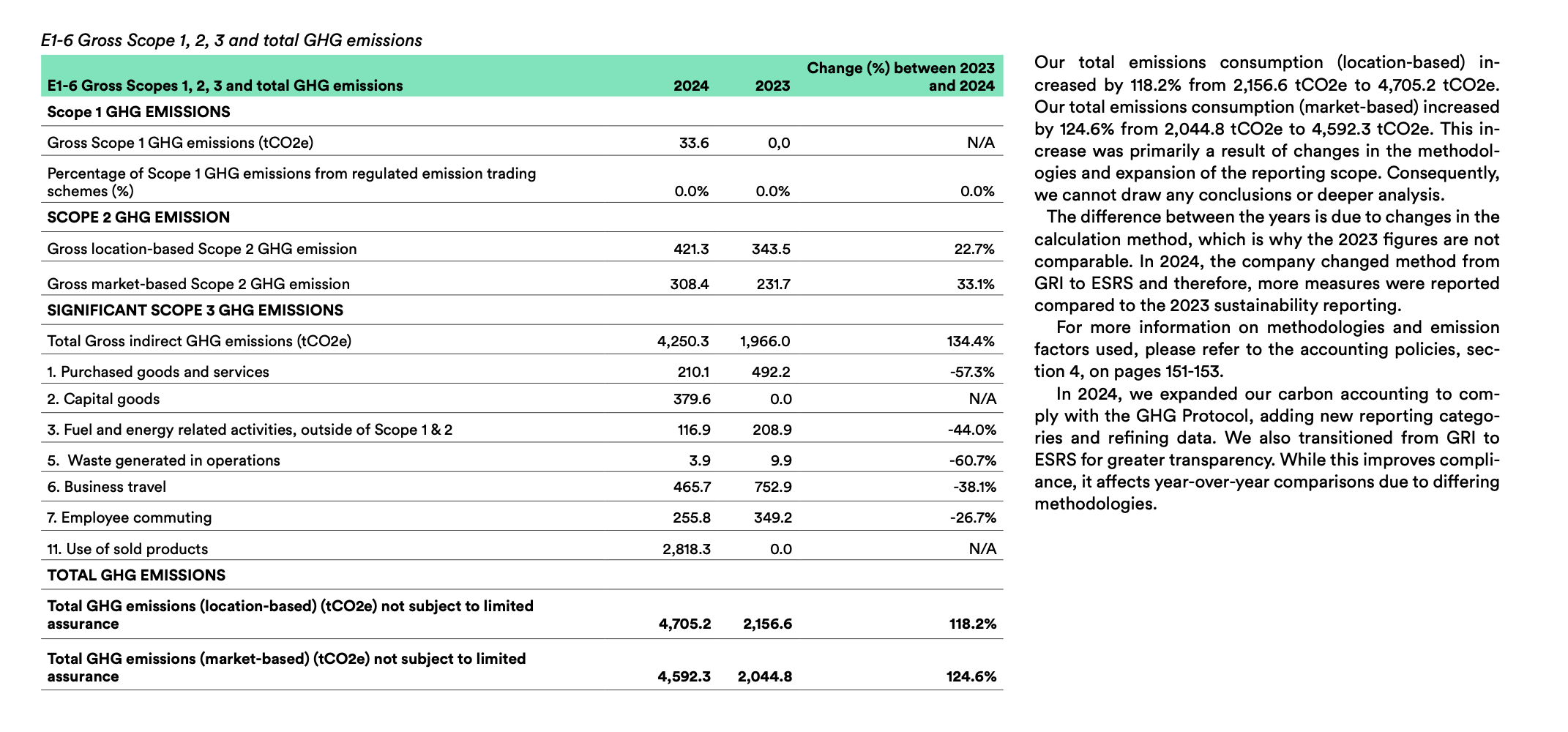

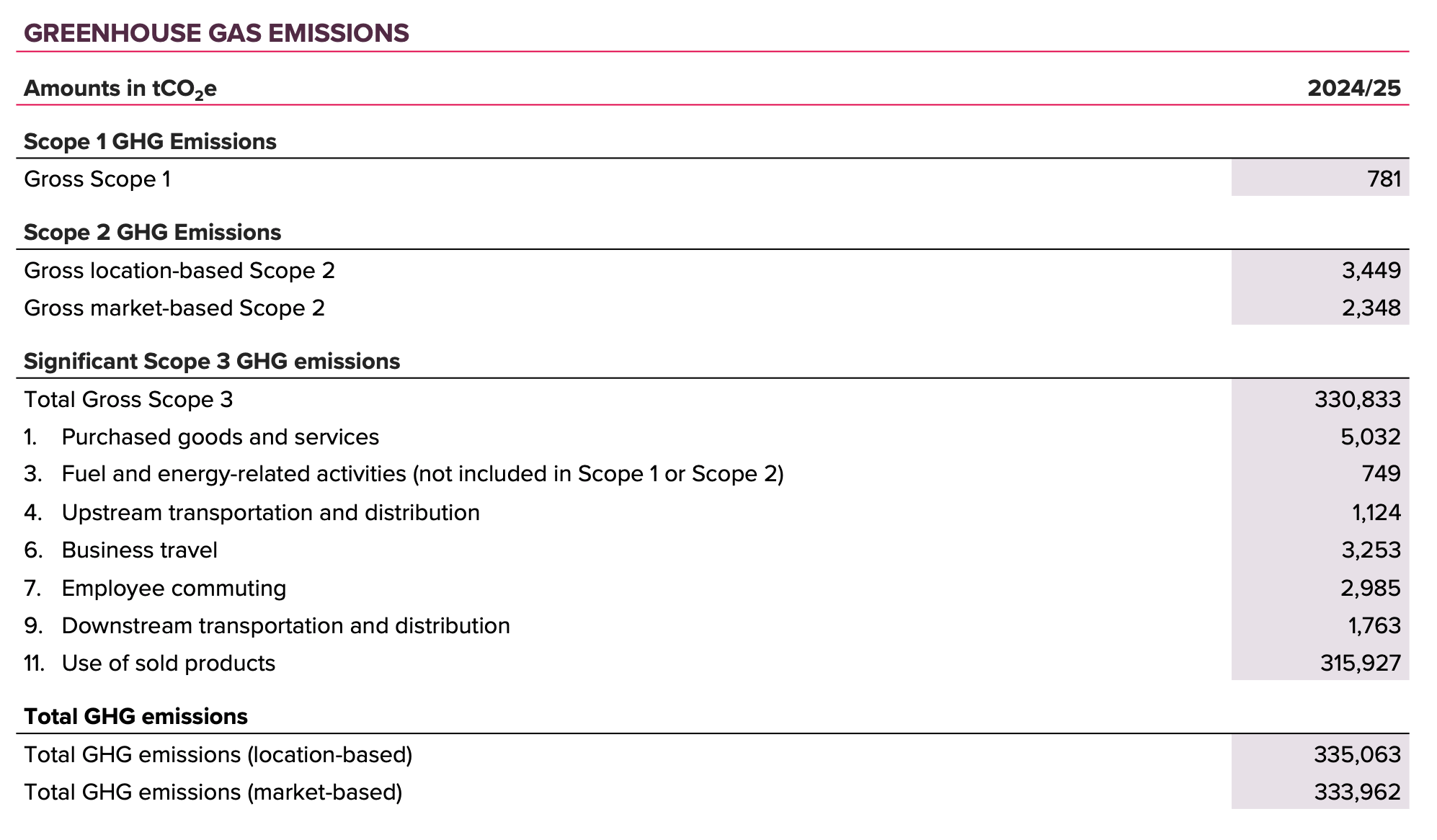

Yes, it's time again to canvas the latest releases from game companies as they tally up their environmental impacts from the past year. First is MTG groups' new report [PDF] which, in keeping with CSRD requirements, adopts the new comprehensive European Sustainability Reporting Standards (ESRS). Lots of interesting details in it, including the climate risk analysis that MTG has undertaken, what topics are assessed as material, and the company's overall footprint.

New methodologies for calculation and acquiring new companies make quite a difference. Nice to see Scope 3.11 disclosures, still all too often omitted in many cases.

Embracer

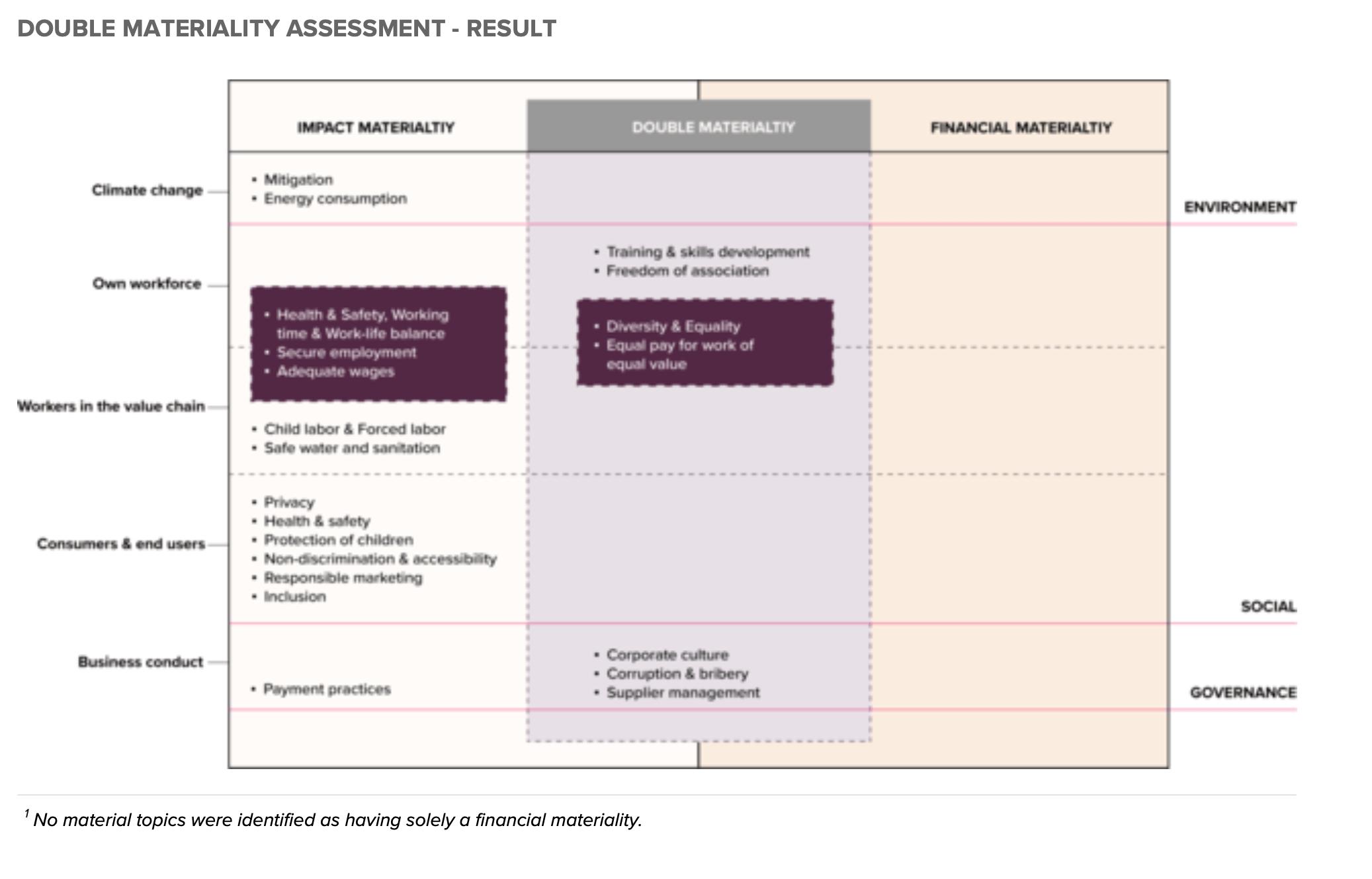

A bit harder to decode this year's report [PDF], and the overall vibe has the feeling of being a bit rushed – perhaps explained by the context of the massive separation of Asmodee that Embracer underwent in the last FY. Here's the double materiality assessment results:

Not a huge fan of this way of presenting the results of the analysis, tbh. At least we get a list of Impacts, Risks and Opportunities later on with somewhat more explanation about each. Embracer does seem to be required to report according to the ESRS this year, but it's a decidedly lighter touch approach this time, and missing some of the same detail we've seen from other first time CSRD reporters.

One key aspect I want to point out is that the organization has reached the following conclusion:

climate change and related dependencies are not expected to trigger significant financial effects to our operations, neither physical nor transitional. It is thereby deemed non-material for reporting from a financial materiality perspective.

Personally, if I were an ESG investor with a large investment in a company of this size, I would be asking to see some of the working-out behind that assessment. Maybe they're right and they have checked for things like physical risk exposure at all of their dozens and dozens of companies. But maybe not. The benefit of more detailed disclosures of the process would let us know. This was meant to be one of the benefits of the CSRD & ESRS.

That aside, what about GHG emissions? As the company has gone through a significant restructure, it has an entirely new scale and profile to operations, and so past years and the most recent year's GHG emissions are not comparable.

As a result, we don't really know whether emissions are up, down, flat, or whether they're on track to meet their SBTi target commitments or not. The changes in business structure do trigger a recalculation of their original targets from a few years ago though, which will happen in the next year or two. One to watch.

GHG Protocol: An update on Scope 2

This is far from definitive, but the GHG Protocol recently posted an update on what they're considering for the next iteration of the most widely used corporate emissions reporting method. Specifically, it's looking increasingly like the next version (due out in 2027) is going to foreground the time-of-use of electricity consumption. This is because in our new world of variable renewable generation, current market-based and location-based reporting doesn't always reflect the reality on the ground. The fact is that 1 kWh of power used at midday on a sunny day, with plenty of solar in the grid, doesn't have the same emissions as 1 kWh of power in the deepest darkest parts of winter. Reporting should reflect that, and I think that makes sense.

Time-of-use reporting for Scope 2 would bring measurements closer to the real-time intensity of power as it’s drawn from the grid, and it's increasingly possible with web services like Electricity Maps and others. Fortuitously, when we were developing the SGA Standard Scope 2 component last year, we anticipated this sort of development and included a forward-looking provision for time-of-use methodologies, accepting outputs from software systems that calculate this way. Neat! Nice to know we got the direction of travel right, even if this is still a few years away.

Nintendo wants to brick your Switch 2 if you pirate games or modify it

I wonder if this would stand up in court, with consumer protections in many (but not all) jurisdictions preventing this sort of lockdown. It's just terms of service, and might never even get used, but still.

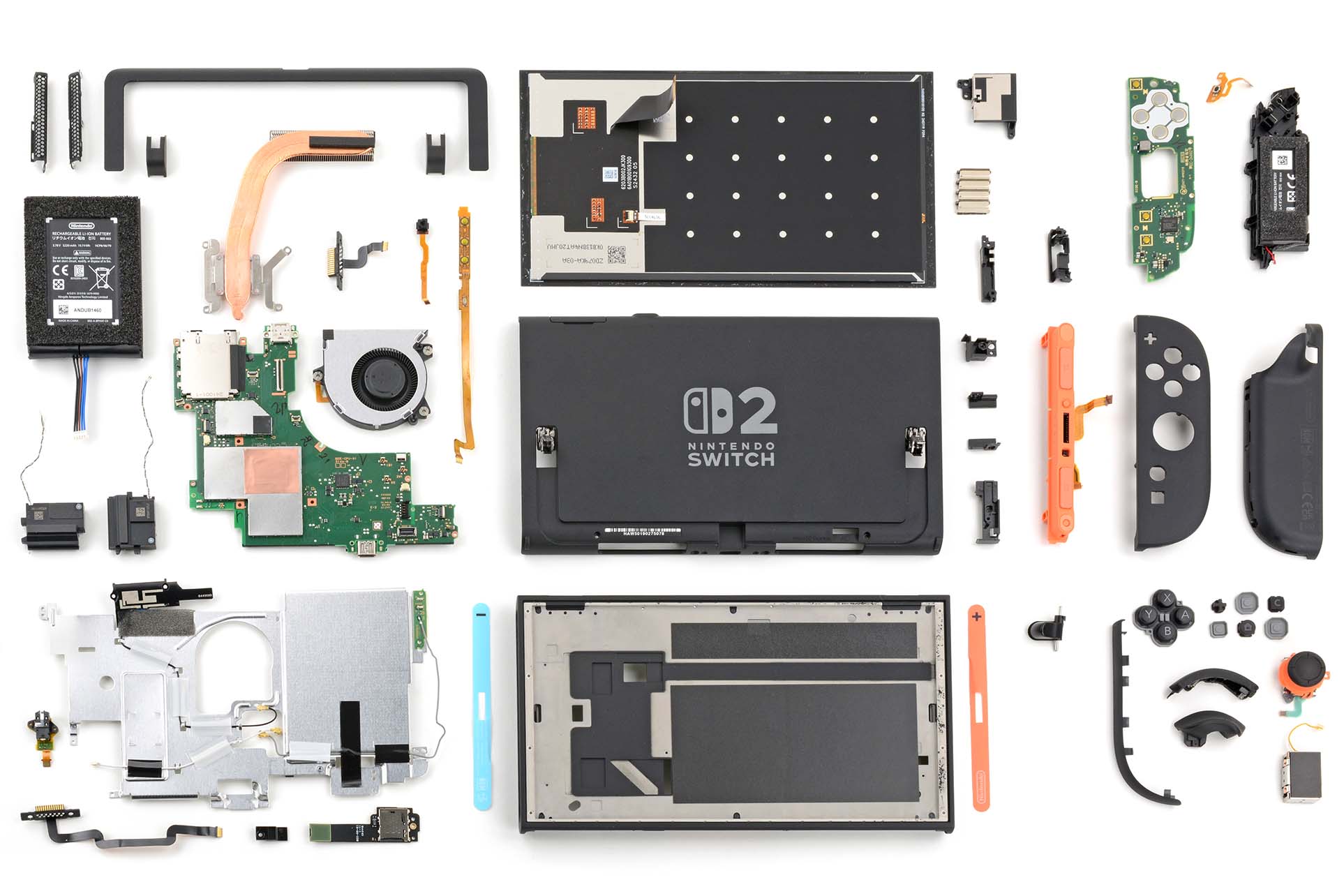

iFixit has also halved the OG Switch repairability score from 8 to 4 out of 10

They explain in the video that they made the change after several years of learning about what good practice looks like, and seeing it in other device manufacturers who have changed the landscape and raised expectations.

iFixit also assessed the new Switch 2 repairability, and gave it just 3/10. Bummerrrrrr.

Your regular data centre & AI news

It wouldn't be another GTG links newsletter without a new series of stories about data centres, AI workloads, and more. It’s the issue that simply refuses to go away.

Workers in the AI value chain

I guess you don’t scale to billion dollar AI chip output without breaking a few eggs. Stories like this from a few years ago absolutely rocked Apple and Foxconn, tanking their reputation for ages. Will this have the same effect on Nvidia?

As an aside - this is the exact sort of thing that the Corporate Sustainability Due Diligence Directive (the CSDDD) aims to make large European companies address, though some politicians and leaders in the EU are currently in the process of trying to water down that down susbtantially.

Nvidia HGX H100 product carbon footprint

Speaking of Nvidia - check out the new carbon footprint assessment of one of their leading AI products. Pretty staggering stuff:

Our PCF determined that the carbon footprint from cradle-to-gate for one HGX H100 GPU baseboard is 1,312 kg CO2e. The central contributors to these emissions are materials and components, accounting for 91% of the total emissions. The production of high bandwidth memory (42%), integrated circuits (25%) and thermal components (18%) are significant drivers of the carbon footprint. Additionally, the assembly process contributes 8.6% of the total emissions, while transportation accounts for only 0.4%.

And some astute analysis of AWS new customer carbon footprint tool

With commentary from Amazon's former VP of Cloud Architecture, Adrian Cockcroft, so you know this is not a case of a journalist just "not getting" it:

As it stands, the CCFT is useful for helping your CFO buy carbon credits, but “it is pretty much useless for optimizing a workload,” according to Cockcroft. “If I’m trying to do workload placement optimization, or measuring something to cut its carbon, the Google data is much more useful.”

The trouble with Microsoft’s carbon figures

And Microsoft is once again being faced with scrutiny. Thought its emissions this year are (blessedly!) lower this year, after several years of increases, they're relying on market-based methods to get there:

If you take Microsoft’s new report at face value, you might think that the massive increase in energy consumption by data centres is coming without any rise in carbon emissions. Reports from other tech titans like Amazon and Meta, which also emphasise market-based emissions rather than far higher location-based figures, tell a similar story.

But a growing body of research suggests otherwise — notably this study led by researchers at Harvard, which found that emissions attributable to US data centres tripled between 2018 and 2023 to reach over 2 per cent of the national total.

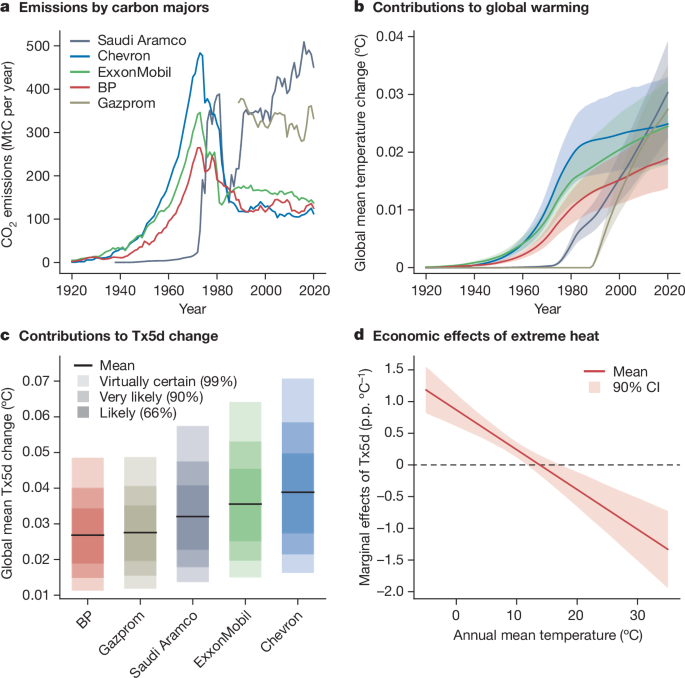

Carbon majors and the scientific case for climate liability

Using scope 1 and 3 emissions data from major fossil fuel companies, peer-reviewed attribution methods and advances in empirical climate economics, we illustrate the trillions in economic losses attributable to the extreme heat caused by emissions from individual companies. Emissions linked to Chevron, the highest-emitting investor-owned company in our data, for example, very likely caused between US $791 billion and $3.6 trillion in heat-related losses over the period 1991–2020, disproportionately harming the tropical regions least culpable for warming.

Climate chaos: the worst flooding in 60 years in northern Nigeria

These didn't seem to get too much coverage what with ~ waves hand ~ everything.

Zombie fires that survive underground through winter in Canada, reigniting in summer

Add “zombie fires” to the list of things that sound like they should be concepts for late-night horror movies, but are in fact real-world consequences of climate change. on.ft.com/3FPpCO4

— JW Mason (@jwmason.bsky.social) 2025-06-10T13:02:36.148Z

Institute for Energy Economics and Financial Analysis: ESG investing and climate risk is not going anywhere

Which makes the following analysis all the more understandable. ESG might be out of fashion in the halls of power, but the underlying risk isn’t going anywhere.

Ancient methods for beating drought

Lets finish with a feel-good story from Ecuador, and the historian who restored ancient lagoons, and brought water back to the people. This is so lovely.

Till next time! Thanks for reading GTG. Don’t forget to register for the meetup!