ESG in China: Alive and well in games and tech?

You don’t have to be a close reader to know that corporate social responsibility in the form of ESG (environmental, social and governance) disclosures has suffered setbacks of late. That might even be putting it too mildly.

Since January, the second Trump administration has attacked DEI (diversity, equity and inclusion) policies and set out an anti-woke agenda, strong-arming much of corporate America into rolling back the sorts of tepid concessions to “progressive capitalism” that liberals and advocates have fought for the last two decades.

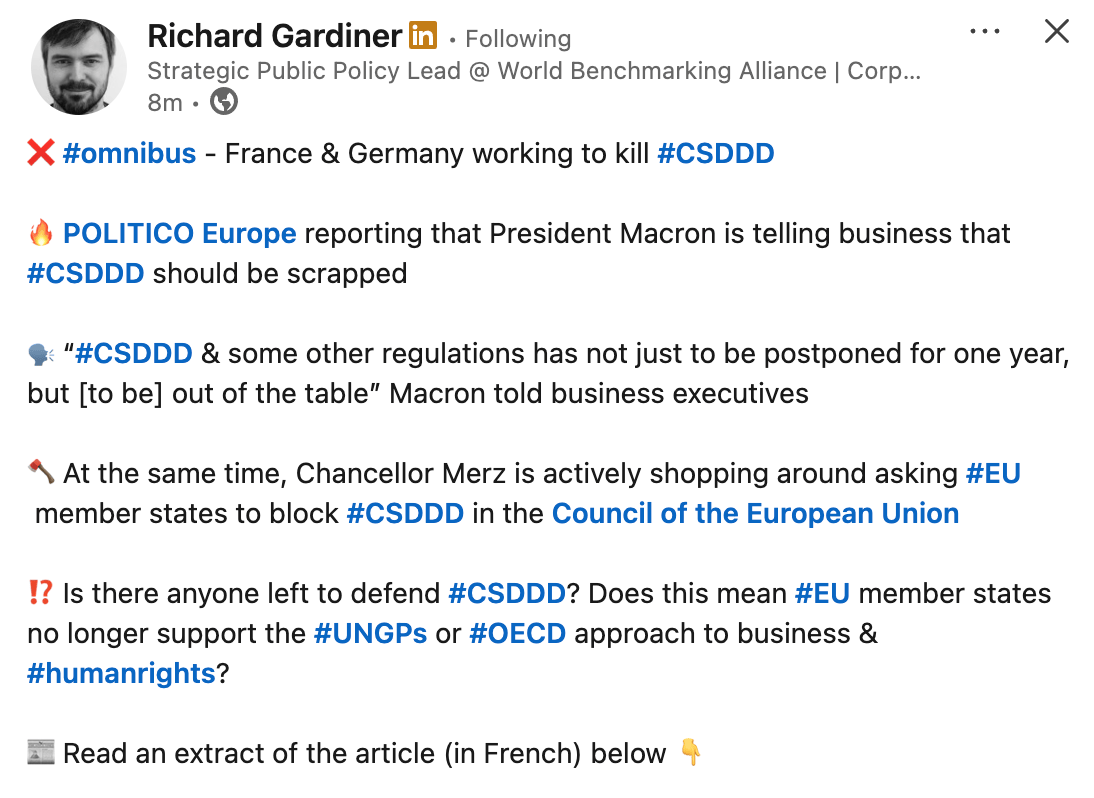

In Europe, seeing which way the wind is blowing, the latest European Commission (now gleefully unbeholden to the Greens and other left parties since the 2024 European Elections) has all but jettisoned its ambition for climate leadership and a rapid green transition. When the Omnibus bill’s “stop the clock” provision passed the European parliament, it delayed the implementation of the EU’s flagship CSRD, CSDDD and other corporate disclosure legislation for as much as two years.

The original form of the CSRD is (or was) the world’s most ambitious corporate sustainability disclosure rules (while also being its most Byzantine and draconian), which Europe, and the world, are now deprived of for all but the biggest Euro-corps. Depending on the outcome of present political negotiations, perhaps for even longer than that: leaders of the German and French governments have been shopping around support for yet further deregulation, which would leave European standards below the OECDs’ own recommended baselines. This is not a 'pause to catch up' so much as permission to stay at the starting line.

Clearly ESG is in a bad way! The winds have shifted, and who corporations think they now must be seen to appease has changed. Or that’s the story anyway.

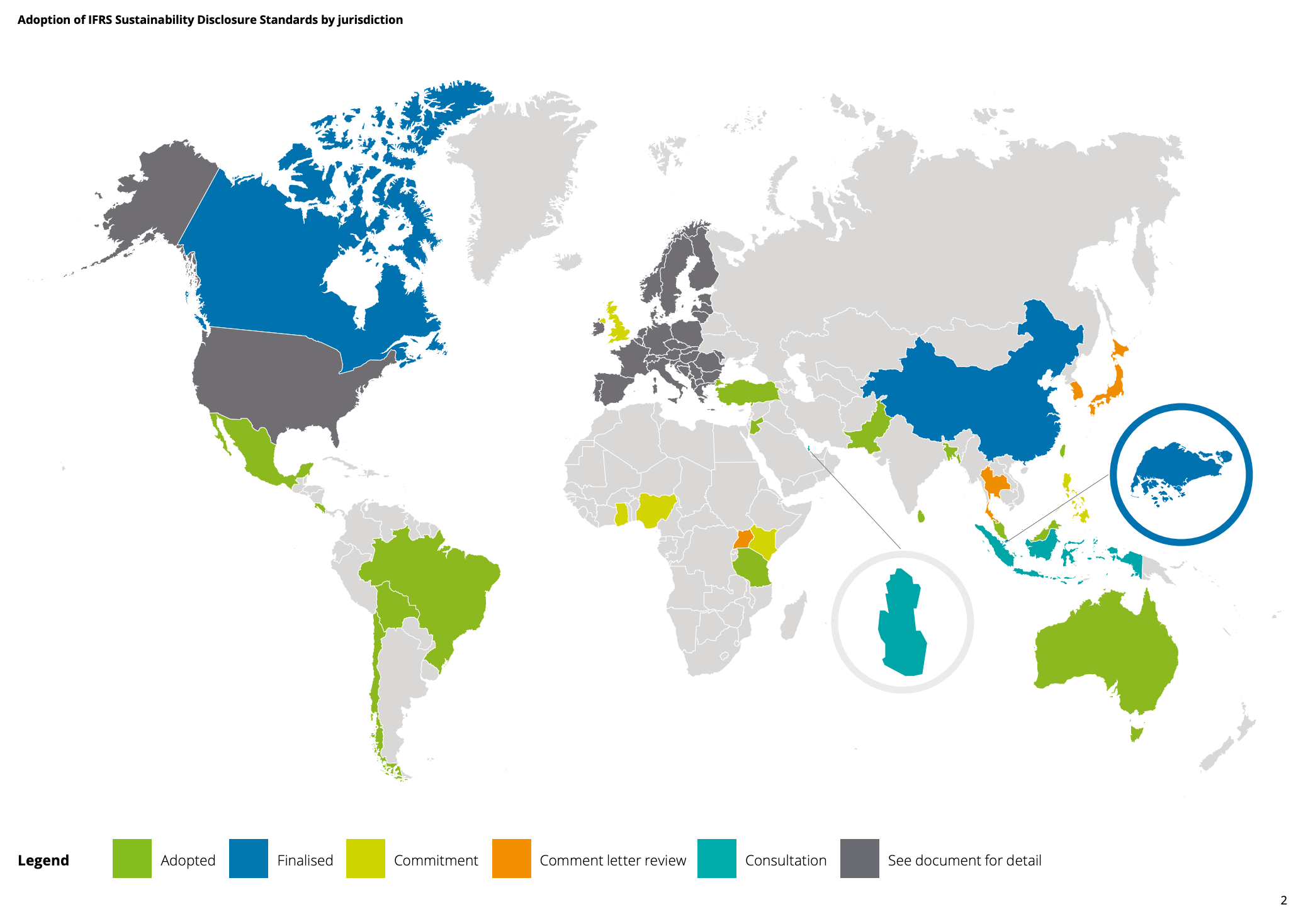

But what about outside Europe and the United States? The IFRS Foundation has been tracking the number of different jurisdictions that have had consultation periods on proposed sustainability disclosures. Granted, these are consultations, but many regions have swiftly moved from consultation to implementing them. Here’s a list of the countries that have consulted about implementing mandatory climate disclosures, going back to the middle of 2023: China, New Zealand, Indonesia, Qatar, Rwanda, Japan, Thailand, Hong Kong, Malaysia, Mexico, Pakistan, Switzerland, Chile, South Korea, Uganda, Brazil, Canada, India, Singapore, Nigeria, Australia, Türkiye, Phillipines, UK, South Africa.

Here's a graphic of countries progress towards adopting these standards from earlier this year (though it seems to be missing New Zealand?), via Deloitte.

Granted, the IFRS S2 disclosure standards that most of these jurisdictions are adopting doesn't achieve the gold standard of the ESRS “double materiality” approach, but it's not even close to being “nothing” either.

For now I want to zoom in on China in particular, and try and discern what’s going on there in terms of corporate disclosures, priorities and strategy. We can do this via some new ESG disclosures from Chinese game & tech companies: tech behemoth Tencent, gaming giant NetEase, and equally substantial gaming company 37Interactive.

Tencent

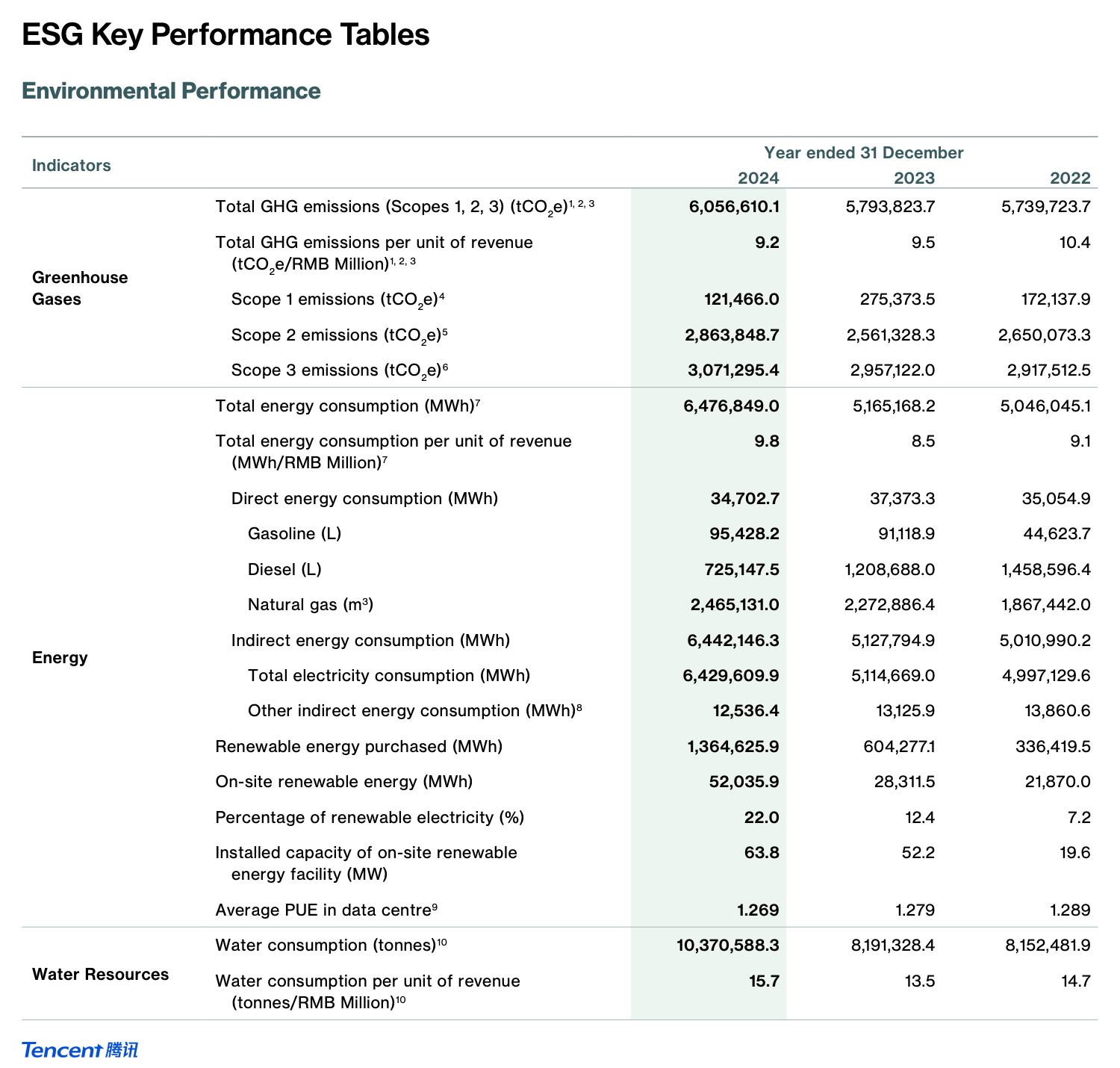

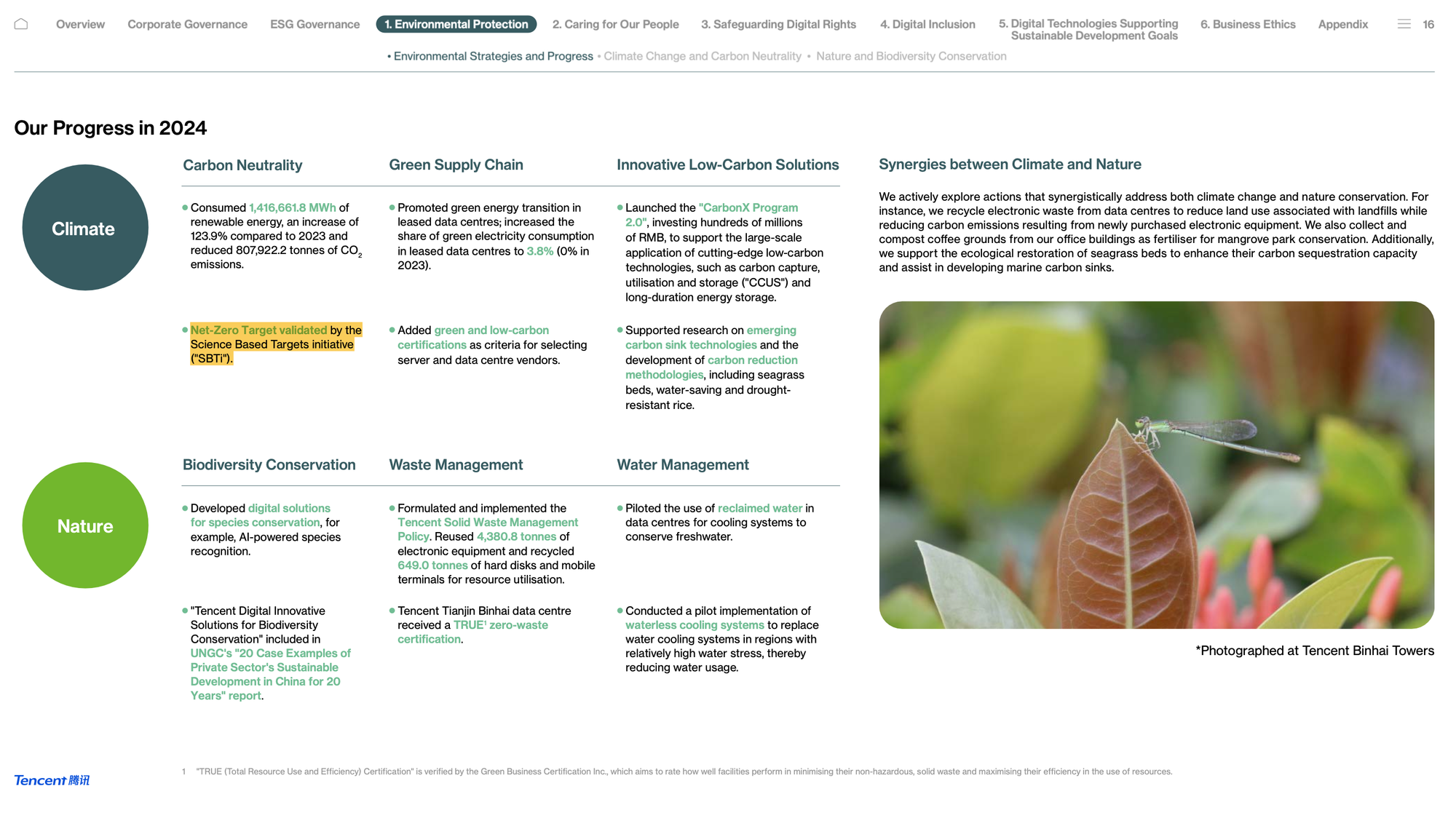

Let’s start with the boring, crunchy numbers. Here’s a link to the full report, and below I’ve included the main GHG disclosure table for their 2024 footprint.

Okay that’s a lot to digest, so let me give you the high-level summary. In 2024, Tencent’s total emissions were higher than the year before, though by only a small amount: about 4 and a half per cent. Not ideal, but there’s also more going on. Take a look at the amount of renewable energy purchased – it has more than doubled from the previous year, up to 1,374 Gigawatt hours. Even though the raw amount of electricity used has more than doubled, the share of renewable electricity has (only) increased from 12 to 22 percent. So Tencent is still growing its electricity usage (probably from cloud and AI type services, if I had to guess), but it’s also growing the overall percentage of that electricity that comes from renewables.

This is a bit of a good news story. It aligns with what we know about China’s staggering success in 2024 which saw a roll out of a truly mind-bending amount of new renewable power generation. This has led to some very well-informed analysts, like Lauri Myllyvirta, to suggest that China’s emissions may have actually peaked (!!) and could well be on a downward trajectory, even with still growing demand for electricity (as seen in Tencent's case).

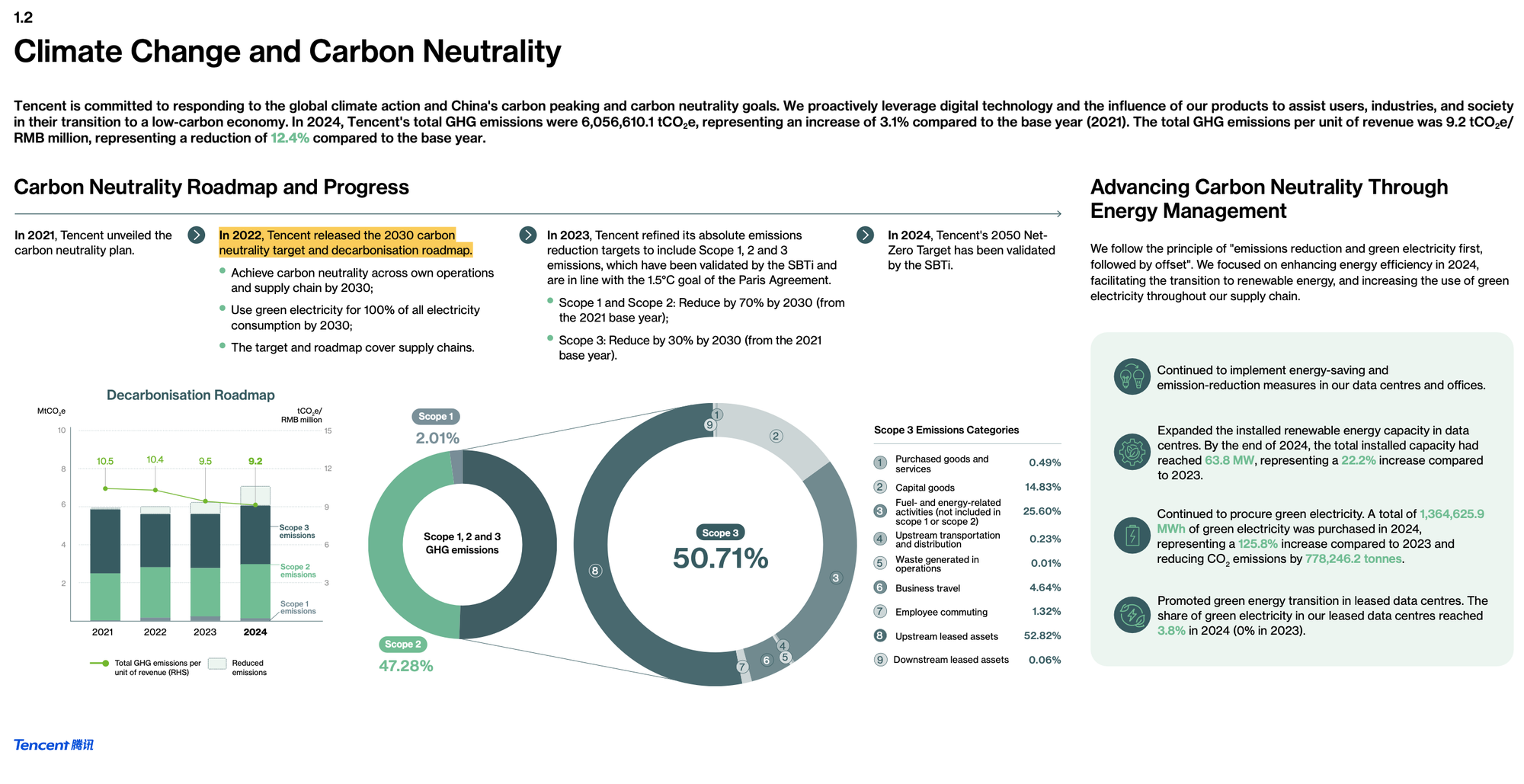

Tencent is also maintaining its commitment to “reduce our carbon footprint and increase the use of renewable energy to achieve carbon neutrality in our operations and supply chains by 2030.” There’s a long way to go there, with only 5 years to do it, but in terms of electricity use, making up 47% of their upstream operational footprint, things are trending positive.

Also, the Science-Based Targets initiative (SBTi) validated their Net Zero targets last year. The SBTi is still, in many people’s eyes, the gold standard for climate action target setting. That validation suggests to me that they have a credible pathway to achieving that result. Not too many companies of the same size can say the same, I think. It’s worth thinking about what that might mean for global corporate climate leadership in 2030. While many Western tech companies’ commitments are looking less and less plausible (looking at you, Microsoft, with their AI gamble possibly blowing up their commitments), Tencent’s is looking kind of achievable.

Granted, Tencent is still only measuring (or measuring and disclosing) it’s upstream emissions – downstream emissions, for instance, the use of sold products doesn’t appear in their accounts, which is a bit disappointing. Perhaps (and this is speculation) for a company as big and diversified as Tencent, there are probably technical challenges that still need overcoming. Issues like, the lack of clear and consistent methodological standards for industries to apply? (Know of anything that might solve that?)

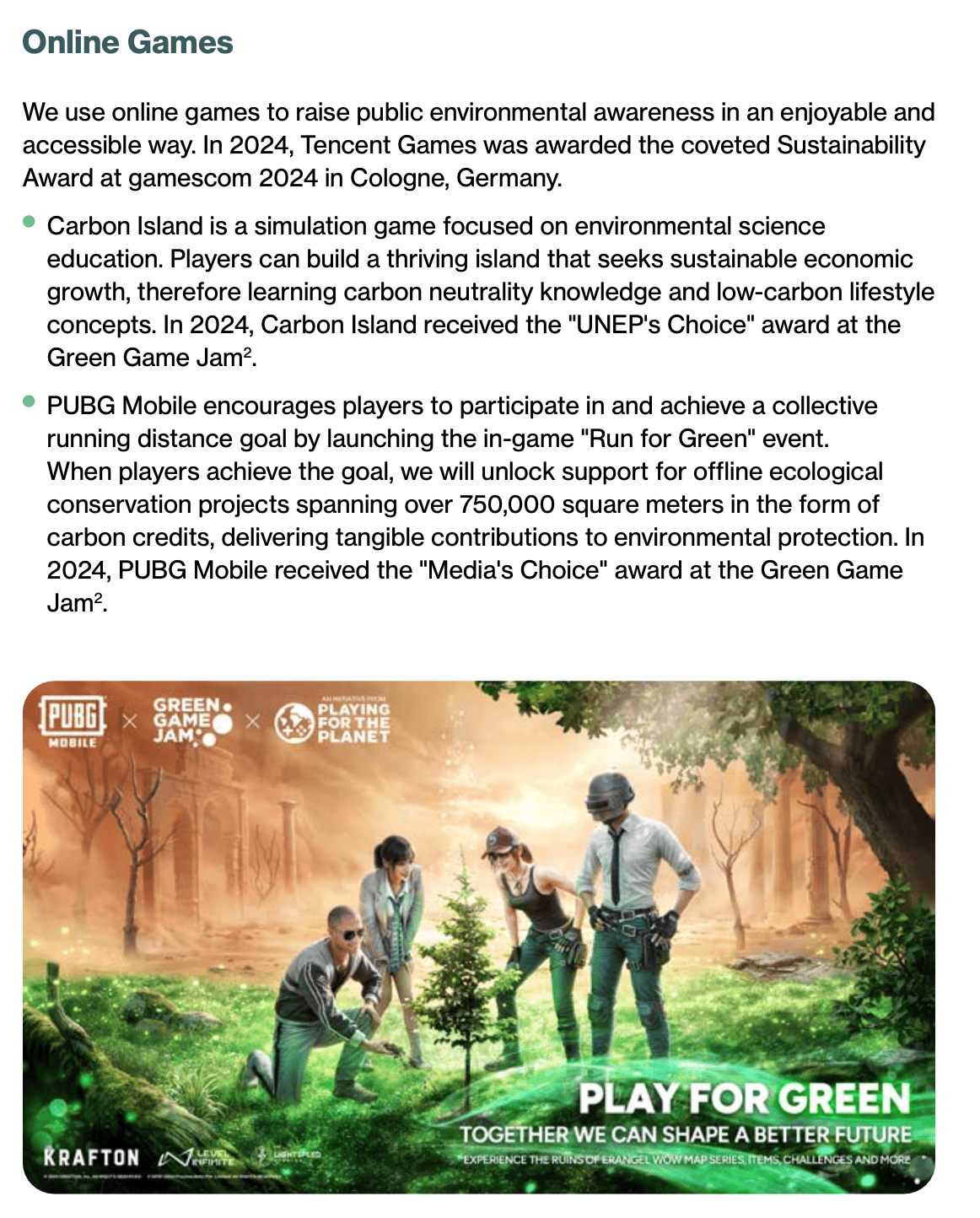

Oh, and gaming even gets a little mention on page 22.

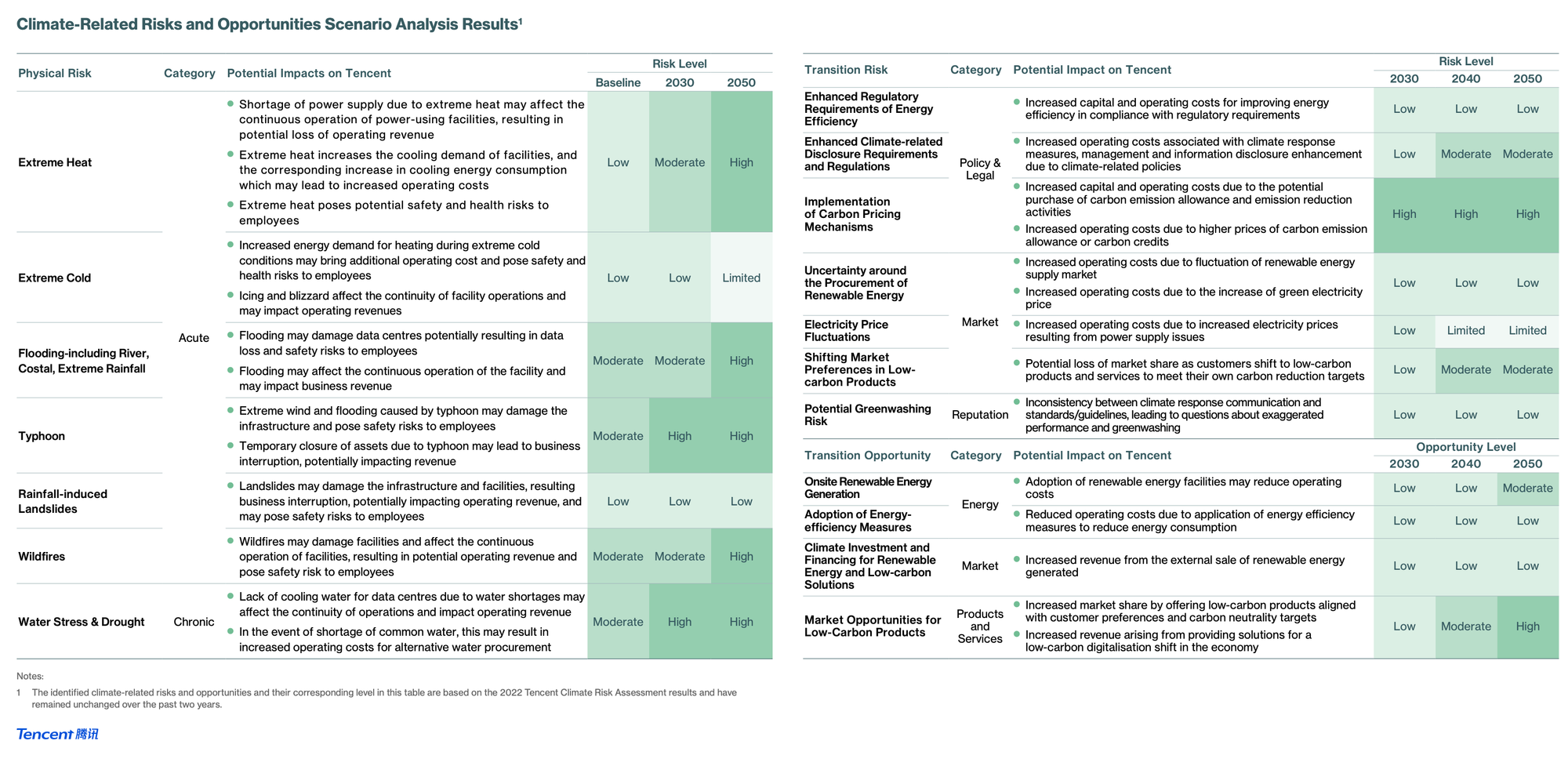

The last thing I want to highlight from Tencent’s ESG report is that there has been some pretty sophisticated climate risk analysis done this year, including the use of multiple scenarios, applied to just about all the main material topics one would expect (pp. 101-102):

Check out all those risks moving from “medium” to “high” by 2050, though. Seems about right to me. 😬

If you’re interested in finding out more about how to do this sort of climate risk assessment, what it looks like for games businesses, and how to make it part of your regular risk management process, register for our SGA Climate Risk Analysis event. It’s coming up on June 4th – just under 2 weeks to go.

NetEase

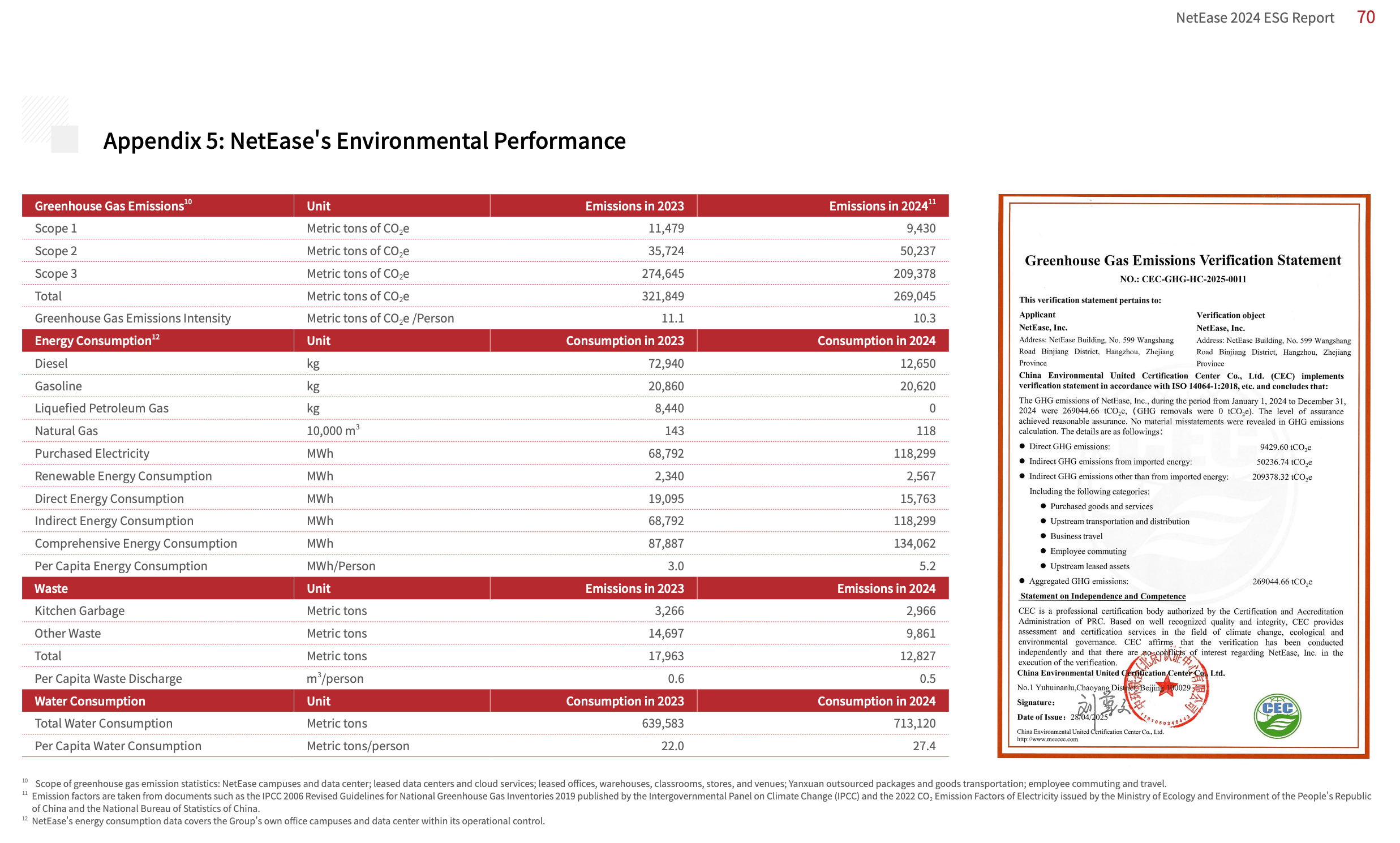

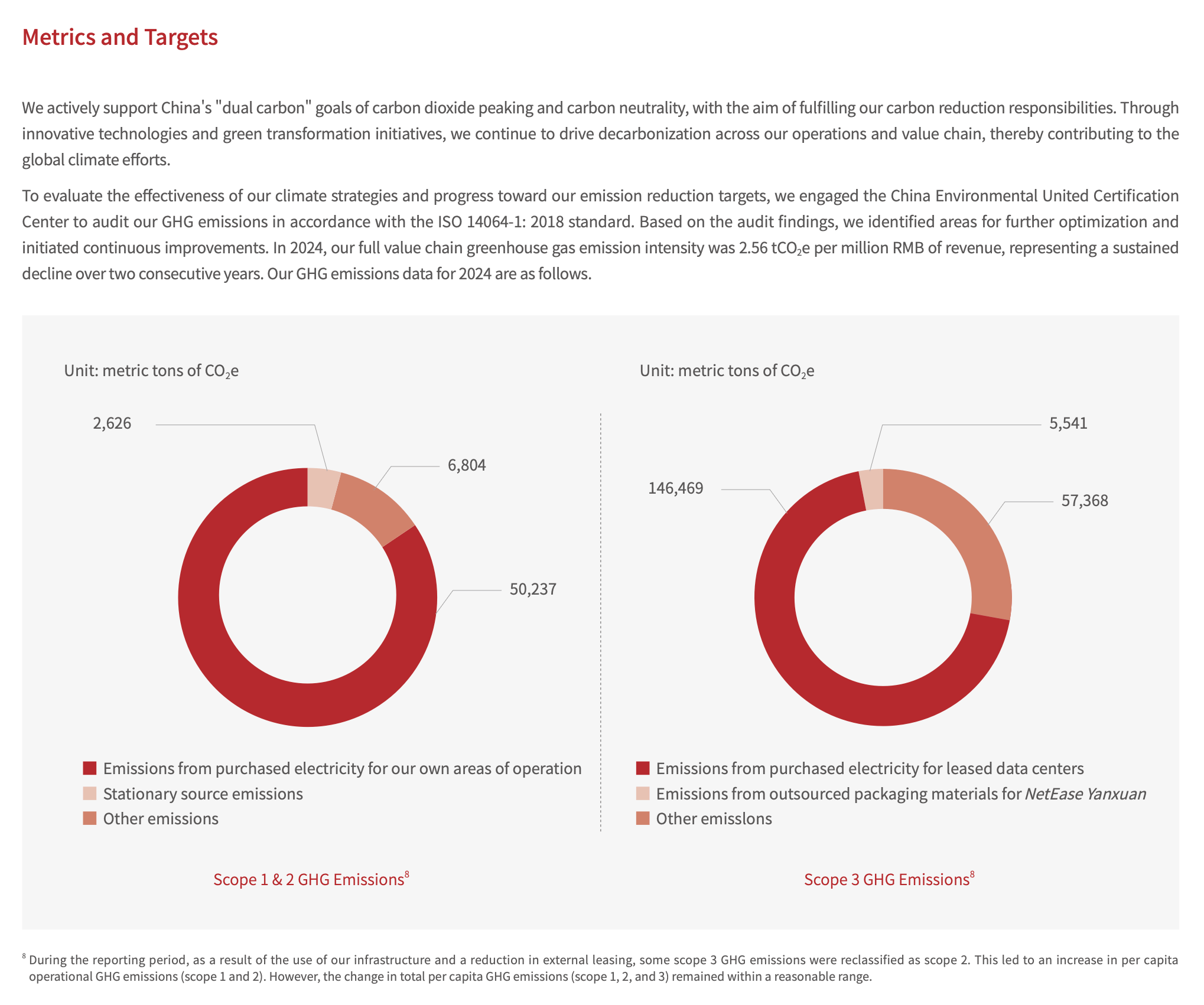

There’s something pretty remarkable happening here too. Let’s start again with the numbers. Scope 1 (direct FF emissions) is down, Scope 2 is slightly up, and Scope 3 is substantially down. NetEase’s total operational footprint in 2024 was a whole seventeen percent less than in 2023. Again, like Tencent, this is only upstream operational emissions (downstream end user emissions are absent), but as far as addressing the most in-your-control emissions, this is really quite positive.

To understand what’s going on with these Scope 3 emissions, it helps to see the percentages of each component of the category. The biggest chunk – almost 3/4 of the Scope 3 total – is, yep, you guessed it, electricity. Specifically: “electricity emissions from purchased electricity for leased data centres”. Here again, the Chinese renewable buildout is facilitating a noticeable decrease in emissions.

Is it only government activity that’s driving this, though? I don’t think so – there seems to be a conscious, corporate effort to choose renewable power across all three companies we’re looking at here. It is surely a benefit to have such a state-led investment in renewables, but my impression is that enthusiastic corporate alignment with it is not necessarily a given.

37interactive

Our third and final example of Chinese ESG reporting (which I have spent a long time painstakingly machine translating, line by line) comes from 37interactive. This one’s a bit of a mess with my annotations all over, unfortunately.

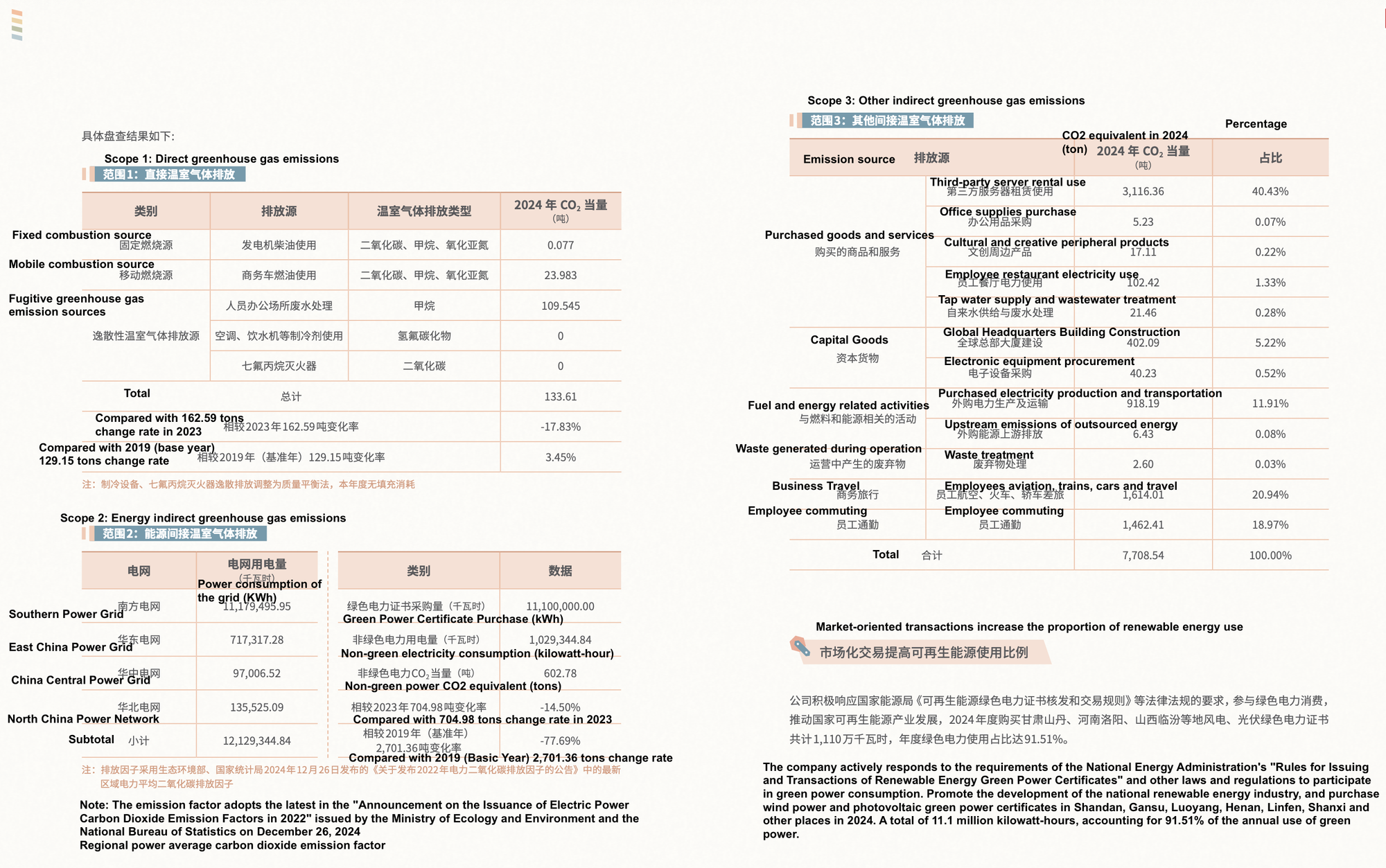

A similar, but even more dramatic story is unfolding here. Total CO2 emissions are down by 30%. Scope 1 emissions have halved (though – last year they netted 200t of forestry credits against their Scope 1 emissions, which is a big no-no; I haven’t seen mention of that again, so fingers crossed), Scope 2 is down even further than the previous year because they’ve upped their renewable power purchasing percentage to a whopping 91.51% (up from a very healthy 81% the year prior), and Scope 3 is down as well with, much like NetEase, third party server electricity consumption being the lions share: 4,561 tCO2e or 43% of Scope 3 last year, vs 3,116.36 tCO2e or 40% in 2024 – dropping a thousand tonnes of CO2 in server electricity in a year can only be the result of increased renewable electricity purchases. Even though the total has DC power emissions have shrunk by one quarter, as a percentage of the scope 3 total, it remains about the same! They’re shrinking the entire Scope 3 pie at the same time.

Okay, so that’s a lot of numbers and percentages – but here’s my final takeaway: China, and Chinese companies, are getting serious about reducing their greenhouse gas emissions. Give it a few more years and it’s becoming very obvious that the moral high ground that the West has looked down upon “polluting, industrial China” will have completely and utterly eroded. Very soon, they will be well within their rights to tell us that we need to shape up and get serious, and embed real GHG emissions control into Western businesses.

To be clear, this analysis is based on the picture that ESG reports paint – things are never quite so rosy or clear-cut in the real world, and we should treat ESG communications like any other corporate comms. There is a PR element to all corporate disclosure. The focus on upstream emissions, while perhaps justifiable for now, will (I suspect) not last forever. And in the downstream portion of Scope 3, a different, less positive story could be hiding. But maybe not. After all, in such a highly digital industry as games and tech, the incredible buildout of renewable electricity generation will have an ineluctable flow-on effect and start to reduce consumers’ own footprints from the playing of games, the streaming of movies, and so on.

The footprint of consumers for games will eventually become a solved problem. It’s only today, in the present world we live in, where fossil fuel power generation still dominates, that we need to take rapid and meaningful action while also being sensible and inclusive, bringing players along with us as participants in this great project. We cannot afford to provoke an anti-green backlash either through unacceptable imposed solutions, or equally tepid greenwashing. Players will see through both.

From flicking through the rest of these ESG reports, the impression I am left with is one of quite meaningful attempts to align corporate goals with society-wide priorities for a green, clean, harmonious “ecological civilisation” in modern China. Chinese ESG will likely not have the same characteristics as it does (did?) in the West, but it’s undeniably delivering. I wonder if, in a few years’ time, we will look back and be able to make out something like “ESG with Chinese characteristics” – if we do, the first signs of it will be seen somewhere in here, in documents like these.