GTG links #24: The One About Supply Chains & Carbon Credits | June 30

Every links post I think to myself "this will be the last one overloaded with news" and every time I'm wrong. There's too much going on, everyone needs to slow down and take a break. Until then, we perservere.

Potential super El Niño building

I am not looking forward to the coming Australian summer.

See 2023 besides Super El Niño years 1997 and 2015: pic.twitter.com/Mo4D8NiLZ3

— Leon Simons (@LeonSimons8) June 22, 2023

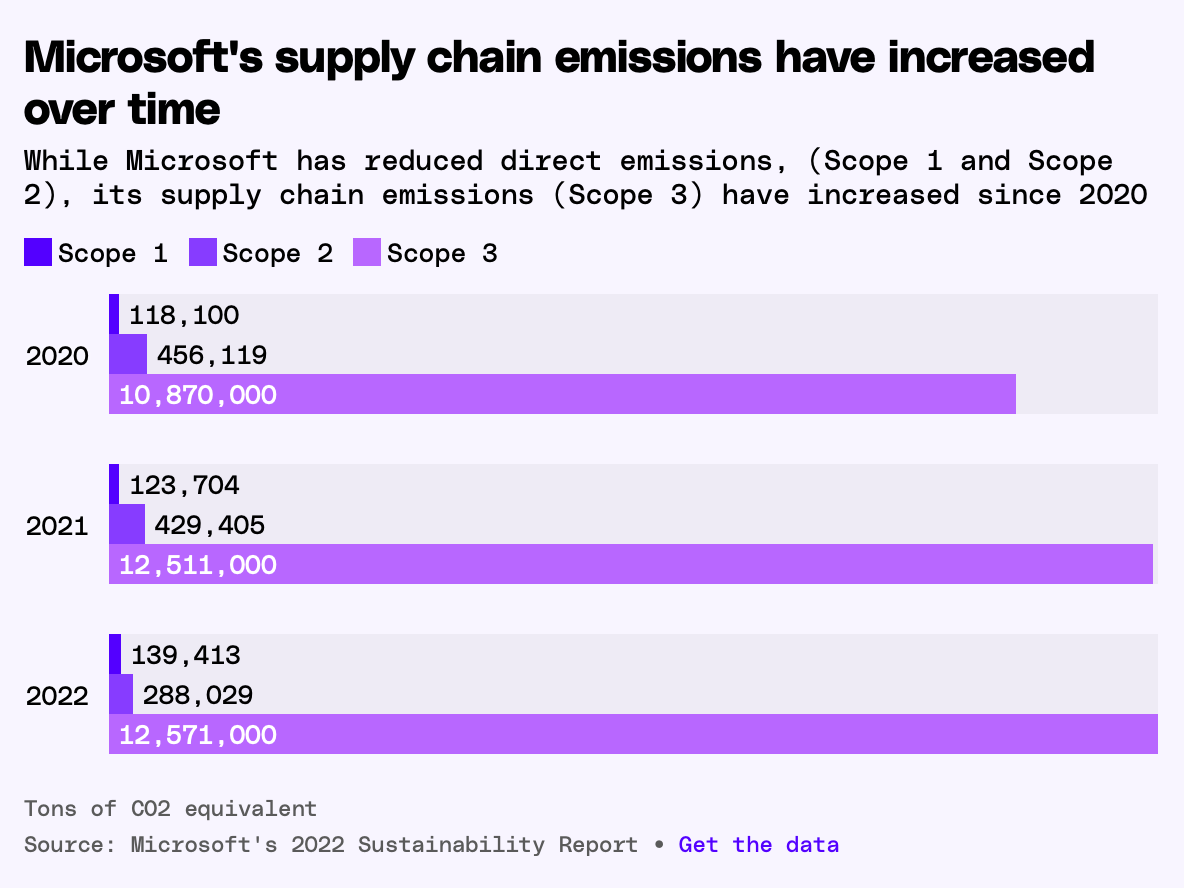

The Verge did some digging in Microsoft’s supply chain and came up dirty…

This is really cool for a couple of reasons. Firstly, it's the only major story I can remember where the media has looked at supply chain emissions in any actual detail. In the past we've gotten a bit of hand-waving at big numbers, gestures to the complexity of the problem, but this sort of near-forensic engagement with suppliers is critical. Good on the Verge!

Secondly, it's cool (though that's stretching the definition a bit) because its a bit reassuring that this is even a problem for Microsoft. There's a long hard slog ahead of us in getting better Scope 3 disclosures – let alone finding ways to actually reduce them – and I'm hoping the SEC doesn't back down when it comes to setting its rules this year. (I'm reading this interesting article on the topic at the moment)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24722321/236701_microsoft_fossil_fuels_suppy_chain_emissions_climate_HHerrera.jpeg)

12.5 million tons of CO2 equivalent emissions that, according to Microsoft's target, needs to come to basically zero (and not by using offsets) by 2030. Lets say that reduction proceeds in a linear fashion – 1.7m tonnes of CO2 savings need to be found in the value chain each year for the next 7 years. Is it even possible? Which suppliers are going to have a hard time zero emissions products? Which ones aren't going to want to, for cost or other reasons? Which suppliers are going to get cut off, substituted for lower emissions ones?

A phrase I read recently, in a very different context, which I think might be pertinent is "Where do we find the courage to do this?"

Greenpeace report on sustainability in supply chains

And that piece links to this Greenpeace report [PDF] from last year with the following summary note:

“Out of the top 10 ranked consumer electronics brands, only Apple had made significant progress in cleaning up its supply chain, the report said. The company achieved this by supporting some of its suppliers in reaching 100 percent renewable energy by 2030 and adding close to 16 GW of new power across its supply chain.”

They're talking about additionality! Turns out its possible to green your supply chain in ways that don't just shuffle numbers around. Makes me wonder if these are some of what Apple’s billion-dollar green bonds went towards…

New research on use of supply chain contracting

Governance by Contract: The Growth of Environmental Supply Chain Contracting

The Article presents the results of a new, original empirical study that demonstrates the remarkably widespread use of environmental supply chain contracting requirements. The study finds that roughly 80% of the ten largest firms in seven global sectors include environmental requirements in supply chain contracting, a substantial increase over the 50% reported by a comparable study fifteen years ago.

Got metals in your supply chain? New data on mines

Meanwhile MS cloud for sustainability tools just added a bunch of new features

Making it easier to get your Scope 3 data from them, it looks like.

And Meta made a splash with a big purchase of carbon credits

But Ketan questions their priorities:

Fundamentally: why is Meta purchasing carbon removal credits?

— Ketan Joshi (@KetanJ0) June 19, 2023

Has it done all it can to reduce its emissions right now? Has it exhausted all other options for its entire footprint? https://t.co/ii837zYMMO

And that's the key qustion. Personally, I don’t think it would be too impossible to find ways to better spend at least some of this money on programs that would deliver actual emissions reductions, both within the company and its supply chain.

Similar questions about Saudi Arabias carbon credit purchase

About 16 firms — including Aramco, Saudi Airlines, Saudi Electricity Company and giga-project NEOM subsidiary ENOWA — bought more than 2.2 million tons of carbon credits in Nairobi on Wednesday in a historic first, according to the organizer, RVCMC. The firms spent $6.27 per metric ton of carbon credits, adding up to an estimated total of $14.74 million.

These CO2 per ton prices are rock bottom as well... which (see below) is no guarantee of quality (good or bad apparently!). Does it change the fact that Petrodollars are only a step up from blood money?

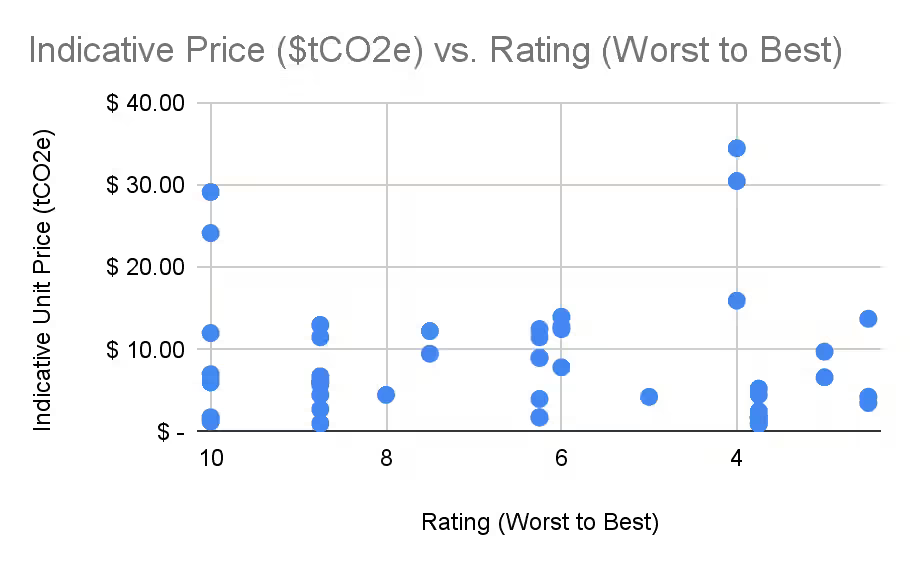

While we're talking about carbon markets, here's some analysis of carbon market dynamics

The post has the following chart about the “weak relationship between project rating and price” which is quite surprising. It suggests there’s some high quality bargains to be found – if the ratings are to be believed.

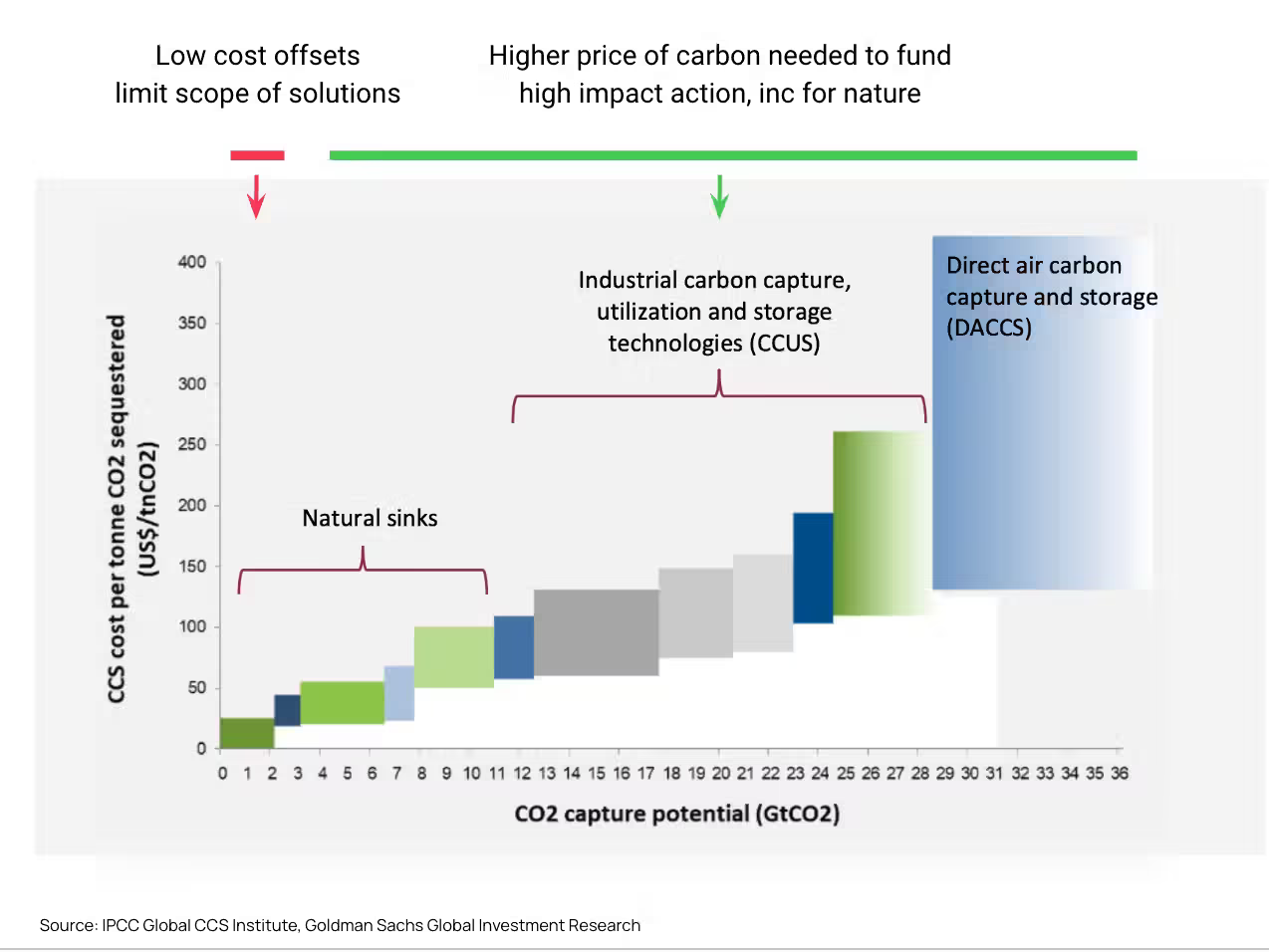

The chart of cost per tonne of different types CO2 sinks is interesting. Natural storage, way too cheap!

Keep in mind, that all current 1.5ºC warming scenarios expect a truly gigantic expansion of direct air carbon capture (the large blue square) – and if these prices don't, or can't, fall fast then we are setting ourselves up for an insane financial hit when it becomes necessary to actually use and pay for them. Compare the first chart of carbon projects which tops out at $40 a tonne with the top end of the second graph, which is $400 a tonne! I'm only an amateur/armchair economist but to me there's a real mismatch there.

And a new carbon offset rating initiative launches

Involving more than just the usual suspects – Carbon Market Watch and the Environmental Defence Fund both apparently in favour of it.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4V7NB34SZRLFPKL4V35QGOZJHQ.jpg)

In more happy news: a net zero steel industry is possible by 2040s

🚨The global steel industry can turn from a hard-to-abate to a fast-to-abate sector.

— Wido K Witecka (@KWitecka) June 15, 2023

Our new report "15 Insights on the Global Steel Transformation" shows how: 👇

1⃣ A net-zero steel sector by the early 2040s is technically feasible. (1/18) pic.twitter.com/iYCgxutMbq

OECD library updates it’s guidelines for responsible business

Adding new focus on sustainability, the OECD has for the first time since 2011, new recommendations for operating multinational businesses. The new guidelines:

...aim to encourage positive contributions enterprises can make to economic, environmental and social progress, and to minimise adverse impacts on matters covered by the Guidelines that may be associated with an enterprise’s operations, products and services. The Guidelines cover all key areas of business responsibility, including human rights, labour rights, environment, bribery, consumer interests, disclosure, science and technology, competition, and taxation.

Some good new ciruclar economy type rules for the EU

“The European Parliament’s environment committee has adopted its position on the EU’s proposed ecodesign regulation for sustainable products, supporting an EU-wide ban on planned obsolescence as well as the destruction of unsold goods like textiles.”

Neat!

And replaceable batteries are going to be required too! Heck yeah. Take us back to the good old days of the Nokia 3310.

Anti-ESG funds not making money – shock horror

“Morningstar’s study categorises the profusion of anti-ESG funds into five subclasses: “anti-ESG,” which invest in companies considered to have been penalised by ESG policies; “political” funds, which invest in companies said to support conservative values; “renouncers,” which formerly claimed to embrace ESG, only to shed the acronym for fear of being associated with it; “vice” funds, investing in “sin stocks,” such as those related to alcohol, tobacco and weapons; and “voter” funds, passive vehicles pledged to vote proxies against ESG measures.”

“In what may be an omen for the investing theme, the sole fund in Morningstar’s “anti-ESG” subclass, the Constrained Capital ESG Orphans ETF, recently filed for liquidation. It has just $3.4mn in assets.”

ISSB new standards

The International Sustainability Standards Board (ISSB) has today issued its inaugural standards—IFRS S1 and IFRS S2 —ushering in a new era of sustainability-related disclosures in capital markets worldwide. The Standards will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions.

And for the first time, the Standards create a common language for disclosing the effect of climate-related risks and opportunities on a company’s prospects.

New Climate Research & Publications

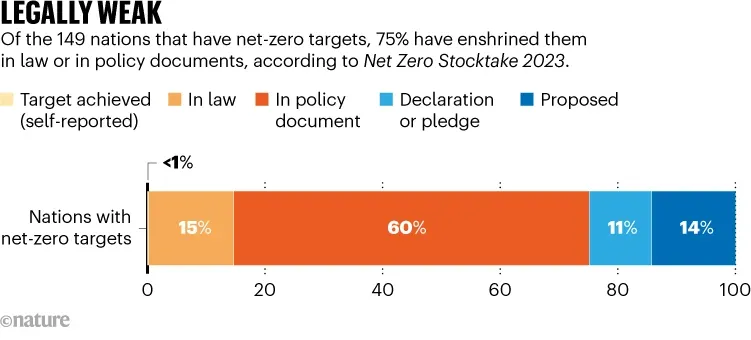

This one is a really detailed analysis of global net-zero pledges. Here's the number of them globally set in actual law:

So that's not as good as it could be. Check out the number of top companies that are adding net-zero goals though. Huge increase over the past 3 years!

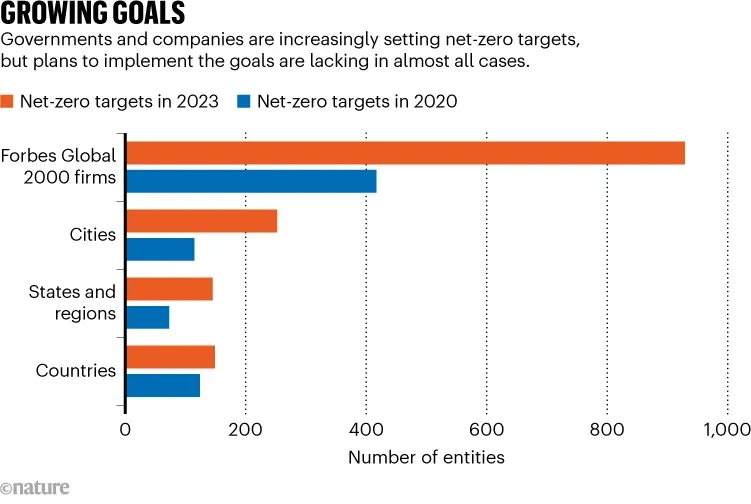

Who stands to lose the most from stranded fossil fuel assets?

Really interesting findings in energy journal Joule – gets the following write-up in The Guardian which explains some more of the implications.

The flip side of it is that public pensions and the majority of ordinary folk actually have relatively little skin in the game of FF asset pricing. So there’s a coalition there ready to be built if we're able.

Neoclassical models of climate damage have delayed climate action

“The passage of the Inflation Reduction Act last summer prompted a discussion of the ways Leah Stokes had been right: clinging to the economist-advised carbon tax and a fixation on externalities, efficiency, and cost-benefit analysis had thwarted progress on climate policy. I tweeted that economists had done damage beyond recommending poor policy instruments: they had significantly contributed to the downplaying of climate harms throughout my lifetime. I pledged that when I was less mad, I would write about it. I’m still mad, actually. Because this matters.”

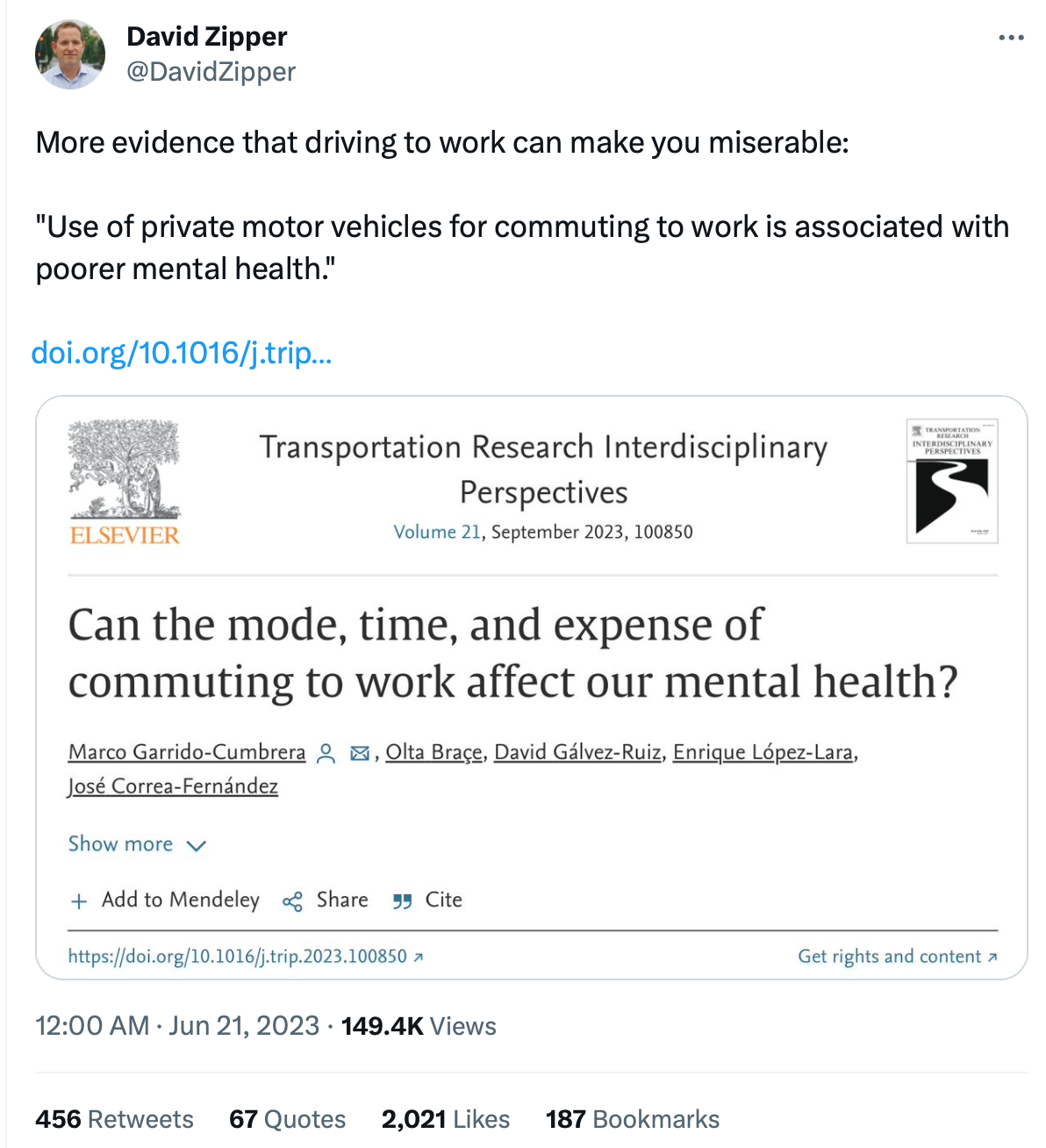

Cars suck – ride bikes!

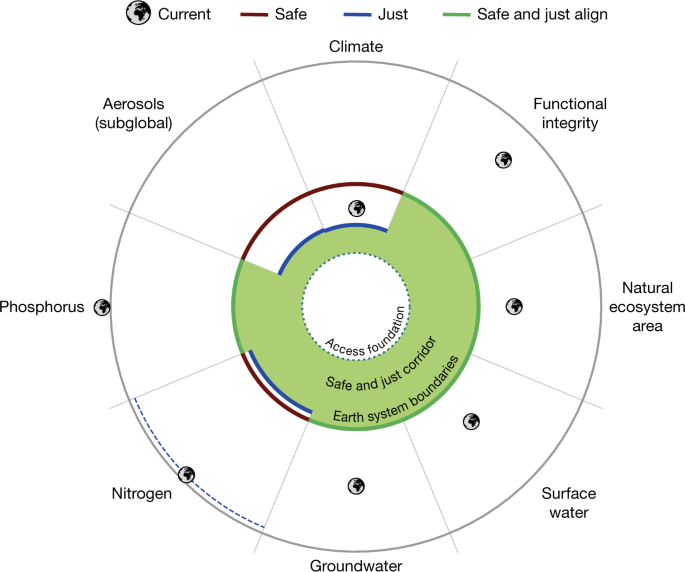

And a superstar scientist group-authored piece on safe planetary boundaries

Stories from the climate front lines

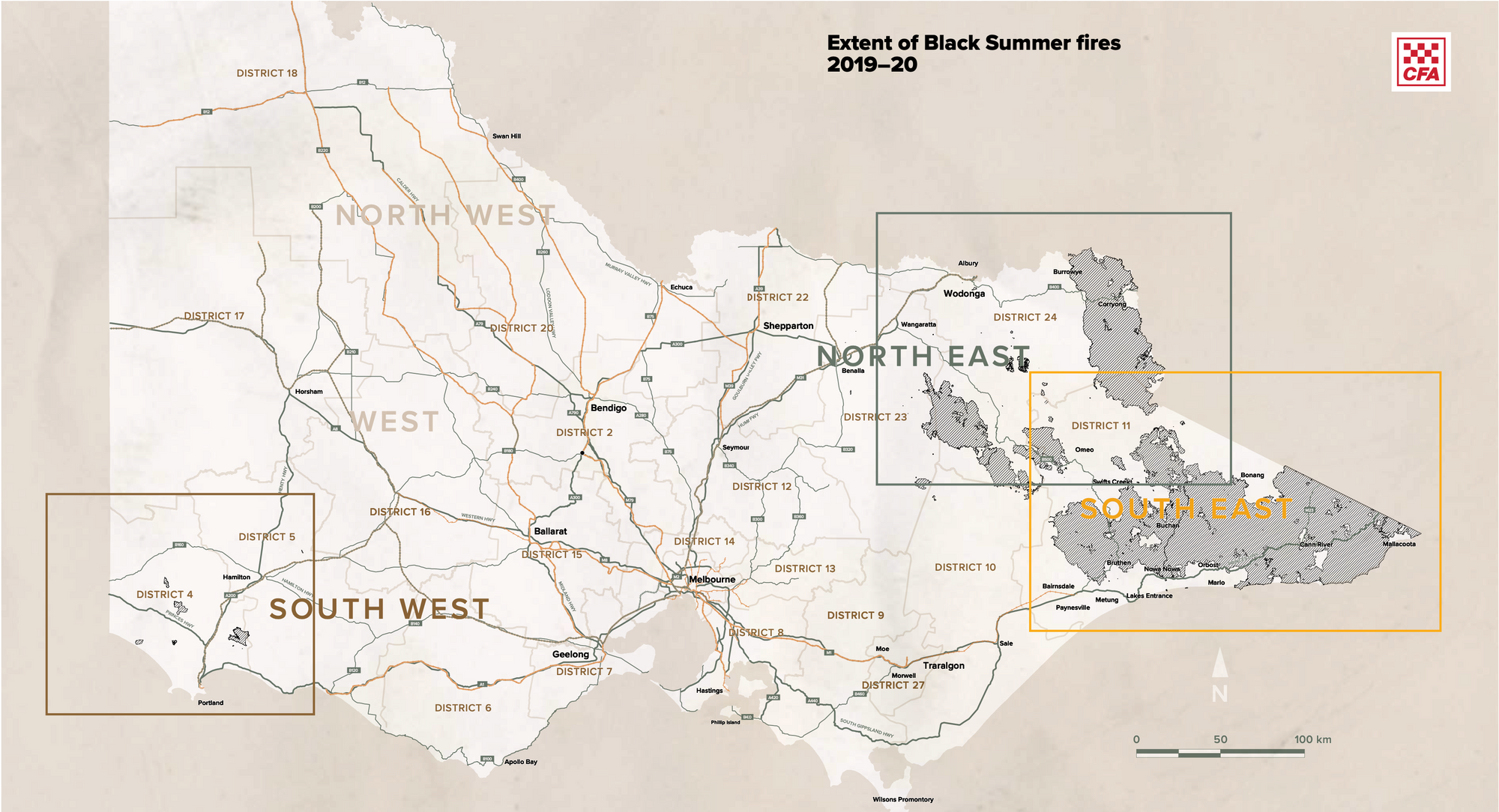

And finally, I wanted to highlight this incredible new book of first-hand accounts from firefighters who were part of the 2019-20 Australian mega bushfires – this kind first-hand storytelling around extreme climate impacts seems really effective, and probably going to become unpleasantly familiar. Very impactful.

I've pulled out two excerpts from different stories that give a sense of what it was like, with hellish conditions at the firefront:

"I was delivering food and water to firefighters trying to stop the fire from heading towards Cudgewa township," says Colin. "I could see the glow before I got there, but as I came over the gap it was like somebody hit you with a blowtorch. There was a mosaic of spot fires, fire trucks, slip-ons, cars and lights everywhere." At 2am it was 44 degrees Celsius [111F] with 60-kilometres-per-hour winds [37 mph] and 7 per cent humidity.”

And another unbelievable story from elsewhere, battling the same blaze, the same extreme conditions:

“The fire arrived at different locations around 8am. “That’s when the gates of hell opened on top of us,” says Rod. “It was enormous – 50- or 60-metre-high trees on the other side of the road had raw flames reaching a third higher again. When the winds hit, it sounded like a jumbo plane.” The fire was overhead, the heat 800–1000 degrees Celsius, the 90–100-kilometre-per-hour wind showering everything in flaming embers. Rod hauled around two lengths of 38-millimetre hose, dousing the station and communications tower. He was almost on his knees with exhaustion when three policemen emerged out of the smoke and offered to help.

...

The fire destroyed 123 houses, including five owned by CFA members, and 65 sheds. “After all the devastation, probably the biggest thing that got to me was the wildlife,” says Rod. “Animals and birds died by the thousands.””

Hey thanks for reading – I know that there's a lot competing for your time and attention these days, so it's especially heartwarming to see people willing to spend time reading. More soon!