GTG Links No. 19 – April 8th

Welcome back to your one-stop-shop for news and analysis for the sustainable games industry. Let's jump right in.

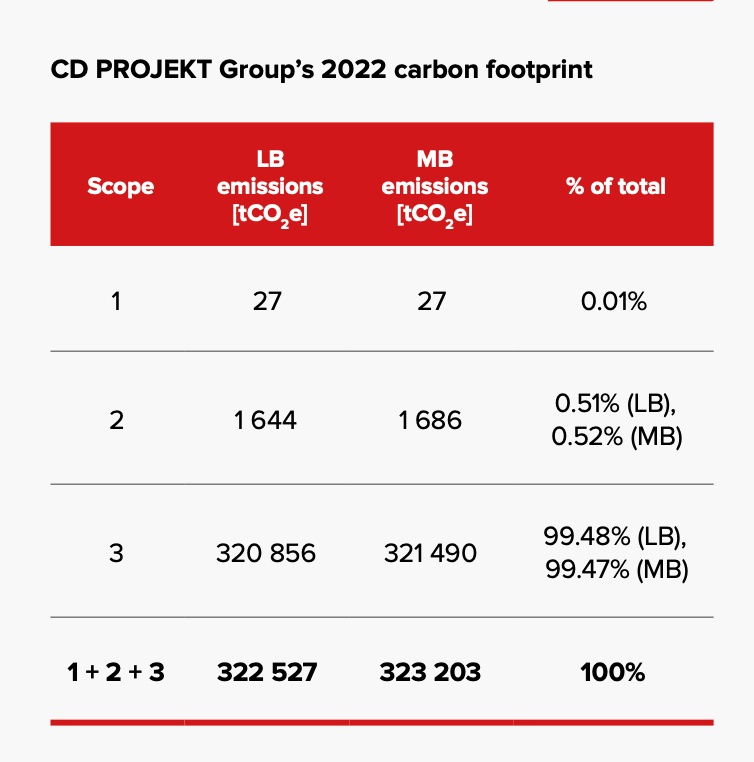

CDProjekt have published their annual ESG report

First one out the gate for 2023 (unless I've missed an earlier one – please let me know if I have) and also the first time CDPR have done a full scope 3 inventory. It's quite amazing to see just how different the breakdowns are across the industry – every business is a bit unique, every one faces slightly different challenges, and different splits between categories. Quite the job ahead to get in there, knuckle down and figure out where and how we reduce emissions at this sort of scale – exciting work to do though. We get to play a part in perhaps the most important issue of our lifetimes.

Here's the table of top-level totals – 99.4% scope 3 might be the most extreme split I've seen yet in a games company. A challenging position to start from, but perhaps also a reflection of the work they've put into greening the CDPR campus already.

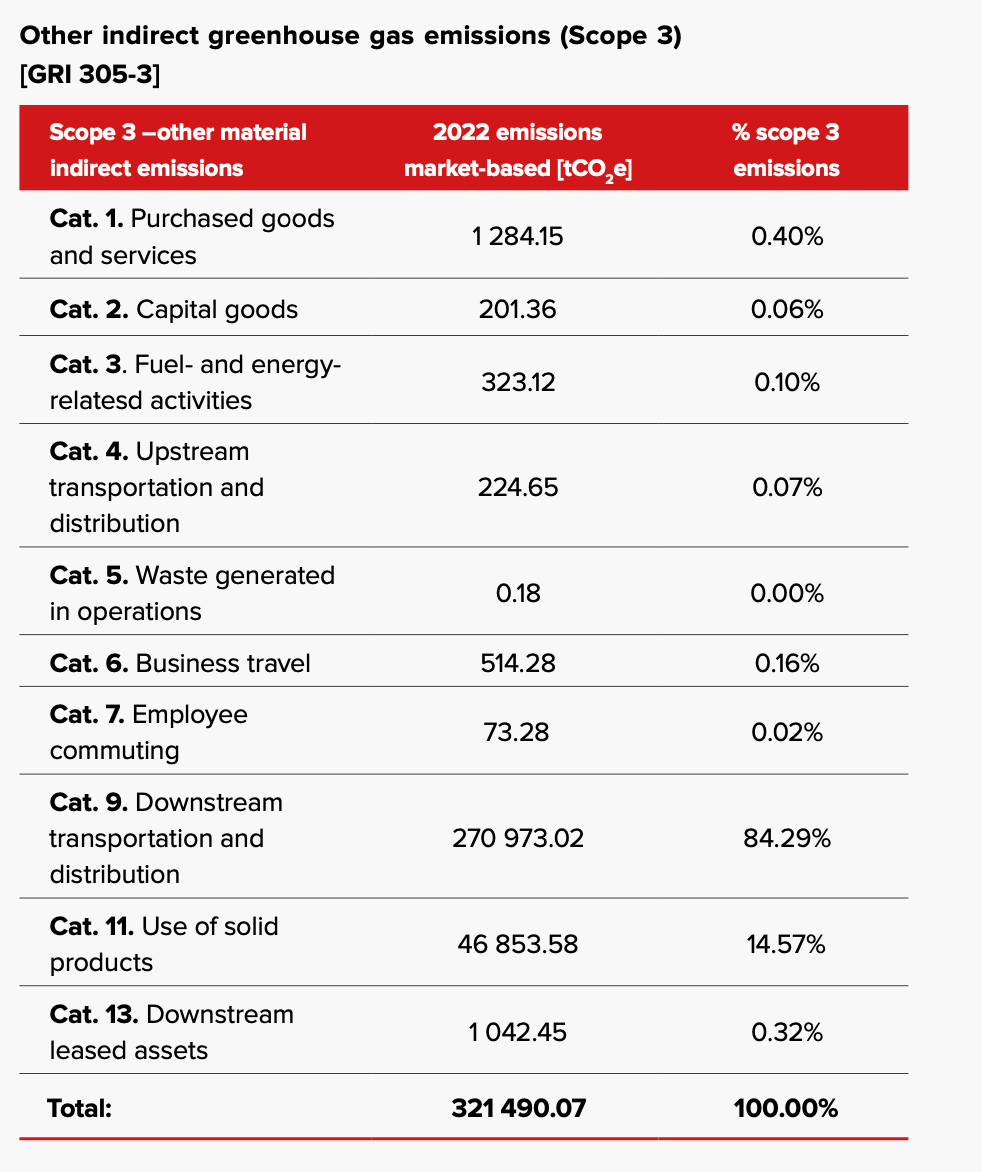

And here's the full breakdown of scope 3 by category – GOG.com downloads seem to be the main part of the footprint. Good thing data centre and internet infrastructure energy efficiency and access to renewables is recieving such intense and sustained attention. Long way to go still.

Having these numbers for GOG.com makes me wonder about even bigger digital distribution platforms. Thinking about the size of Valve's Scope 3 gives me full-on vertigo. Now there's a company that could make a substantial intervention.

Xbox's new controller has more recycled plastic

As part of some research I did for the Green Games Guide (for board games – I think I've mentioned that here?) I looked into some of the challenges involved in plastics recycling. It's really hard, so I have some sense of what an achievement this is. Still, I'd rather design out the use of plastics altogether, but that's a tall order.

Nintendo now repairing all Switch joycons that are affected by stick drift

But only in EU countries – boooo!

My launch era switch has had pretty bad stick drift for a few years now. Part of why I don't play it as much as I used to. Repair is a sustainability issue! A position backed up by some new ADEME research into the environmental benefits of refurbished tech (as summarised here by Backmarket):

The first (published) review of Digital Games After Climate Change

It's truly a privilege to have readers engage with your work, and its a special feeling to have them be this kind and generous in their evaluation. I'm glad it's getting out there and getting read. As always, if you can't get hold of the (outrageously priced) print copy, hit me up for the PDF version.

Turning eWaste into Jewellery

This is one of the coolest things I've seen in a while. Some of these look straight out of a Star Wars costume department.

“The jewelry collection consists of refurbished and reimagined amalgamations of mobile phone circuit boards, USB sticks and plugs, and charging cables with sustainably-sourced diamonds, emeralds, sapphires and rubies.”

Slimmed down websites reduce CO2

VMWare on energy efficiency and links to climate costs

Data centres waste heat used to warm public pools in the UK

This is such a feel good story – win win for everyone.

“We built a small data centre in Exmouth leisure centre. Most normal data centres waste the heat that the computers generate. We capture ours and we give it for free to the swimming pool to heat the pool,” Bjornsgaard told BBC Radio 4’s Today programme.

Blackrock backing ESG disclosures – but also fossil fuels 😠

Larry Fink's annual chairmans letter on global markets and issues facing investors is often picked over for hints as to how the masters of the universe are seeing things. It didn't seem to make as much of a splash this year, perhaps not really articulating much new, or perhaps it was simply drowned out by the release of the latest IPCC report, but it's worth pulling out a couple of climate related aspects of the letter:

For years now, we have viewed climate risk as an investment risk. That’s still the case. Anyone can see the impact of climate change in the natural disasters in California or Florida, in Pakistan, across Europe and Australia, and in many other places around the world. There’s more flooding, more wildfires, and more intense storms. In fact, it’s hard to find a part of our ecology – or our economy – that’s not affected. Finance is not immune to these changes. We’re already seeing rising insurance costs in response to shifting weather patterns.

Funny though that climate risk doesn't translate to taking any sort of position on the livability of planet earth:

...as I have said consistently over many years now, it is for governments to make policy and enact legislation, and not for companies, including asset managers, to be the environmental police.

So until fossil fuels stop producing returns Blackrock will still keep drinking that garbage:

We are working with energy companies globally that are essential in meeting societies’ energy needs. To ensure the continuity of affordable energy prices during the transition, fossil fuels like natural gas, with steps taken to mitigate methane emissions, will remain important sources of energy for many years ahead. BlackRock is also investing, on behalf of our clients, in responsibly-managed natural gas pipelines. For example, in the Middle East, we invested in one of the largest pipelines for natural gas, which will help the region utilize less oil for power production.

Murder Offsets

Fantastic little video on the moral bankruptcy of various kinds of 'offsets'. An unfair comparison? Maybe a little. But only a little.

Firefox “power profiler” shows the energy/performance of web developer’s code – more like this!

Geothermal batteries?

NVidia says crypto adds “nothing of value” to society lol

Thinking about supply side interventions? Check out this new report

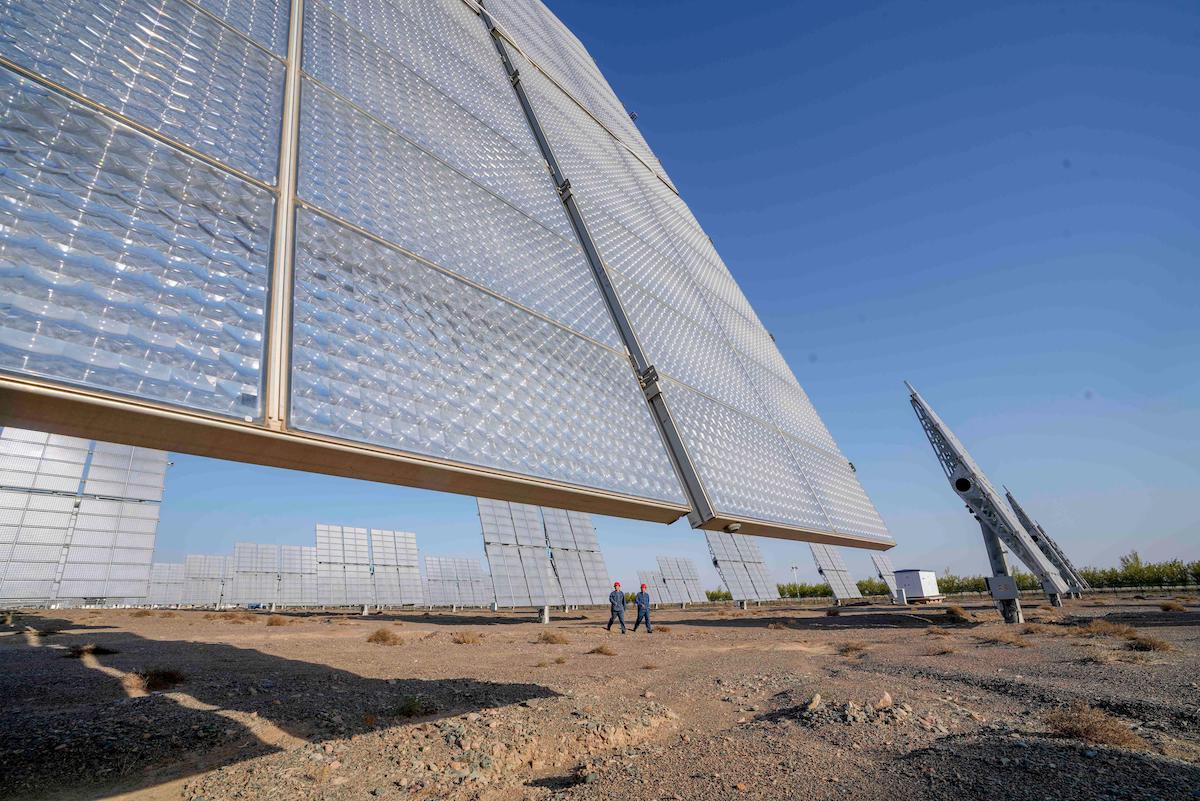

And lastly, interesting (if dissapointing) feature of Chinese renewables deployment

Renewables in China have not begun displacing coal yet because of the unique nature of the Chinese power system, which is much more centralised and planned than most western market-based approaches.

Here's the money quote:

Those arrangements meant investment in renewables triggered a net expansion in coal power; in other words, without that wind and solar investment, the associated coal power construction and generation would not have happened. The two are complementary. Records for existing transmission lines (for 2021, 2020 and 2019) confirm this: wind and solar accounts for 20–40% of power sent by most cross-regional transmission lines. A new line planned to run from Hami in Xinjiang to Chongqing will come with 10 GW of renewable generation and 4–6 GW of coal power.

Climate Corner: climate change brings an early spring to parts of the US

In New York, one of several US cities to experience its warmest January on record, spring conditions have arrived 32 days before the long-term normal, which is its earliest onset of biological spring in 40 years of charting seasonal trends by the National Phenology Network.

“It’s a little unsettling, it’s certainly something that is out of the bounds of when we’d normally expect spring,” said Teresa Crimmins, director of the National Phenology Network and an environmental scientist at the University of Arizona. “It perhaps isn’t surprising, given the trajectory our planet is on, but it is surprising when you live through it.”

And the worrying Antarctic current slowdown

Thanks for reading Greening the Games Industry. Thanks for bearing with the adjusted schedule these past few weeks.